Monthly commentary BMS September 2017

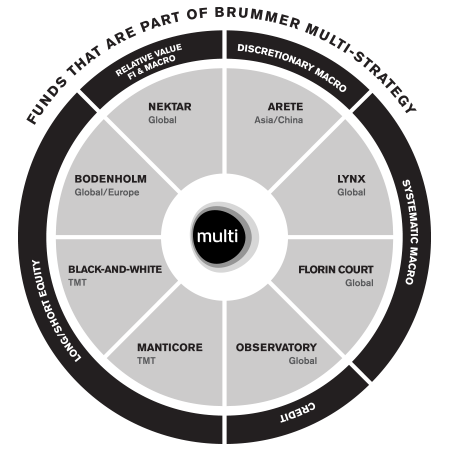

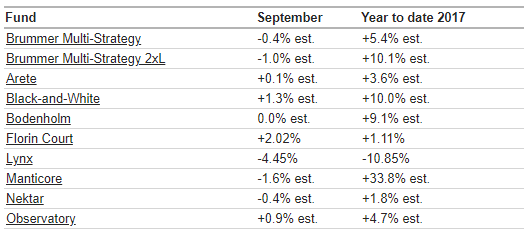

Brummer Multi-Strategy (BMS) returned -0.4 percent in September bringing year-to-date performance to 5.4 percent. Meanwhile, Hedge Fund Research’s Fund-of-Funds Composite Index gained 0.4 percent, which brings its performance in 2017 to 5.5 percent.

Global equity markets soared to new highs in September after a temporary slump. Geopolitical tension and the future of monetary policy were two of the main themes during the month, while risk appetite among investors remained high. In FX, the British Pound gained on the US Dollar, which in turn strengthened versus the remaining G5 currencies. Both UK and US interest rates increased during September. In commodities, energy prices increased further partly due to harsh weather in the US and continued OPEC output cuts.

Performance among the funds in which BMS invests was quite mixed in September, even among funds within the same type of strategy. Central bank statements towards the end of the month caused reversals in a few assets, which took a toll on some of the funds’ performance. While Florin Court had another strong month supported by gains in Power and credits, Lynx was set-back by broad losses in FI, FX and commodities. Trend disruptions in the US Dollar and metals prices were among the main factors for its detracting positions. Manticore was negatively impacted by positions in primarily software and semi-conductors. Black-and-White and Observatory reported positive returns, which in both cases were driven by long positions in equities and credits respectively.

Leading up to October, the allocation to Florin Court was increased somewhat relative to the other funds.