Monthly commentary BMS December 2017

Brummer Multi-Strategy (BMS) returned -0.9 percent in December, resulting in +6.4 percent return for 2017 (estimates). Hedge Fund Research’s Fund-of-Funds Composite Index (HFRI), trading in US dollar, increased by +0.9 percent last month, bringing its performance in 2017 to +7.7 percent. The corresponding currency class for BMS decreased -0.6 percent in December, closing out the year at +8.5 percent.

Global equity markets showed diverging performance during the final month of 2017, which was yet another strong year for equities. Passage of comprehensive US tax reform during last year’s final month, was albeit expected, positive news to markets and helped buoy US large cap stocks. In currencies, The US Dollar strengthened versus the British Pound, but weakened against the Euro and the Swiss Franc. Meanwhile, oil and precious metals led gains in commodities.

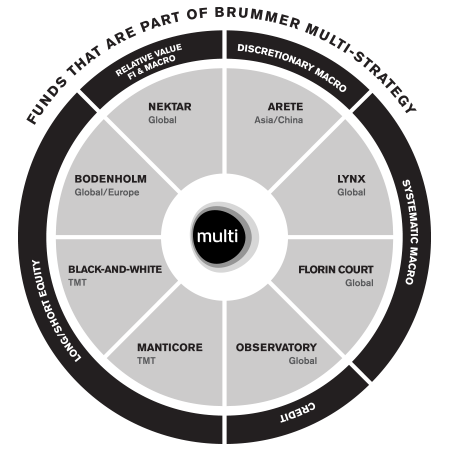

BMS’s return in December was negatively affected by primarily long/short equity fund Manticore, which ended a strong year with a weaker month. Relative value and macro fund Nektar and long/short equity fund Bodenholm also had a negative impact on BMS’s performance. The largest positive contribution of the month came from the systematic trend-following fund Florin Court, with positions in energy and credits driving returns. Asian macro fund Arete, long/short equity fund Black-and-White along with the credit fund Observatory, also reported solid gains, positively contributing to BMS during the month.

When recapturing 2017, BMS had its second-best year since 2009. Six of the eight constituent funds have generated positive returns during 2017, where the long/short equity strategies were the primary contributors to BMS.