Monthly commentary BMS June 2018

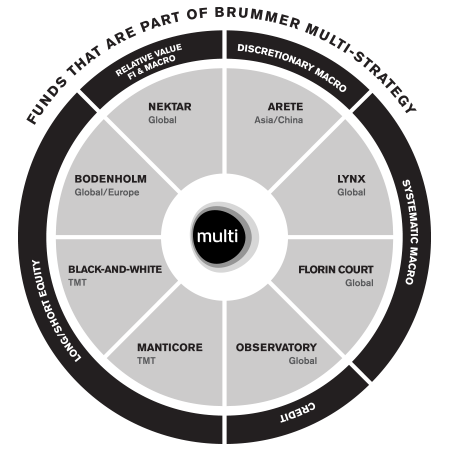

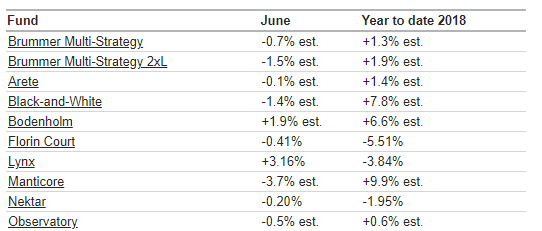

Brummer Multi-Strategy (BMS) declined 0.7 percent in June, resulting in year-to-date performance of 1.3 percent. Hedge Fund Research’s HFRI Fund-of-Funds Composite Index declined 0.2 percent in June and has returned 1.2 percent year-to-date.

Global equity markets posted mixed results in June, with slight gains in the US and declines in Europe and Asia. US interest rates remained relatively unchanged despite a new rate hike by the Federal Reserve. Meanwhile, the dollar strengthened against most other major currencies. In commodities, oil prices continued to climb, while metals declined.

Several of the funds in which BMS invests struggled during June, with negative returns as a result. There were no major macroeconomic or sector specific development which mutually affected the funds’ performance, but rather certain positions within the funds’ investment themes which were at cause. Positive contributors to the portfolio were long/short equity fund Bodenholm and systematic trend-following fund Lynx.

Ahead of July, the portfolio managers reduced the allocation to Observatory and increased the allocation to Bodenholm.