Monthly commentary BMS February 2019

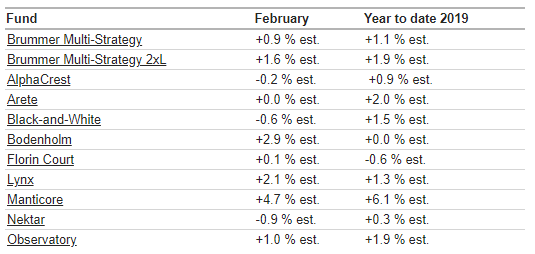

Brummer Multi-Strategy (BMS) SEK generated an estimated return of 0.9 per cent in February (1.1 per cent for the USD class).

The risk-on rally continued in February on the back of increased optimism over US-China trade relations as well as a more dovish stance from major central banks. US and European bonds sold-off at the end of the month after the Federal Reserve shed more light on its plans to reduce holdings to complete its balance sheet normalization. Equity markets continued higher with volatility falling while results from earnings season have generally been mixed. The British pound strengthened further following expectations that a no-deal Brexit can be avoided.

BMS’s performance in February was largely attributable to the long/short equity funds Manticore and Bodenholm. The systematic trend-following fund Lynx also had a good month generating gains in equities, commodities and foreign exchange. Nektar was the primary detractor in February with volatility and foreign exchange positions proving costly.

Going into March, the portfolio managers increased the allocation to AlphaCrest.