Brummer Multi-Strategy monthly commentary November 2020

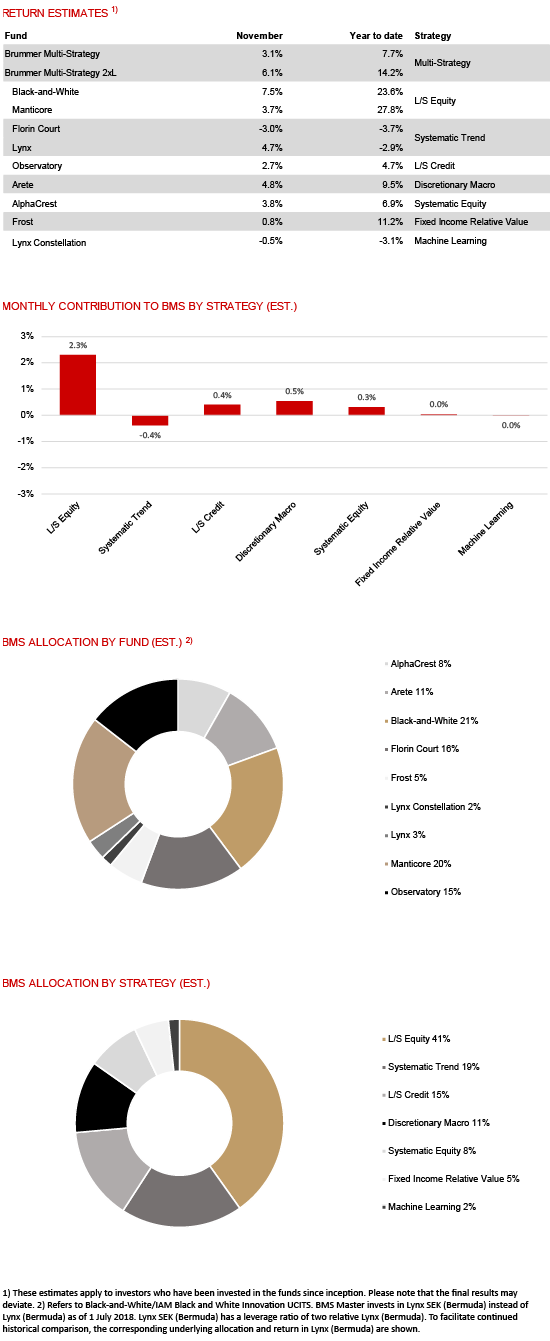

Brummer Multi-Strategy (BMS) SEK and Brummer Multi-Strategy 2xL (BMS 2xL) SEK posted estimated returns of 3.1 and 6.1 per cent respectively in November (3.1 and 6.1 per cent for the corresponding USD classes).

MARKETS

A record month for many equity indices, November saw a sharp increase in risk appetite propelled primarily by vaccine breakthroughs and a decrease in political uncertainty following the US elections. Haven assets struggled, with both the US dollar and gold prices falling during the month. In commodities, oil prices recovered somewhat from pandemic lows while industrial metals rallied.

STRATEGIES WITHIN BRUMMER MULTI-STRATEGY

Performance in November was largely positive across the investment strategies within BMS. Long/short equity strategies Black-and-White and Manticore delivered solid alpha on the back of a strong earnings season and navigated the mid-month sector rotation from growth to value stocks well. Market neutral systematic equities strategy AlphaCrest was also positive with the majority of its returns driven by its machine learning focused strategies. Macro focused Arete profited from the rise in equity markets as did trend following strategy Lynx with profits also in foreign exchange positioning. Long/short credit strategy Observatory made money on idiosyncratic trades while fixed income relative value strategy Frost contributed marginally. Systematic trend following strategy Florin Court was the month’s main detractor with losses primarily from its power, rates and equity positions. Machine learning strategy Lynx Constellation detracted marginally.

As of December 1st, BMS’s portfolio managers made only minor adjustments to the portfolio.