Brummer Multi-Strategy monthly commentary October 2020

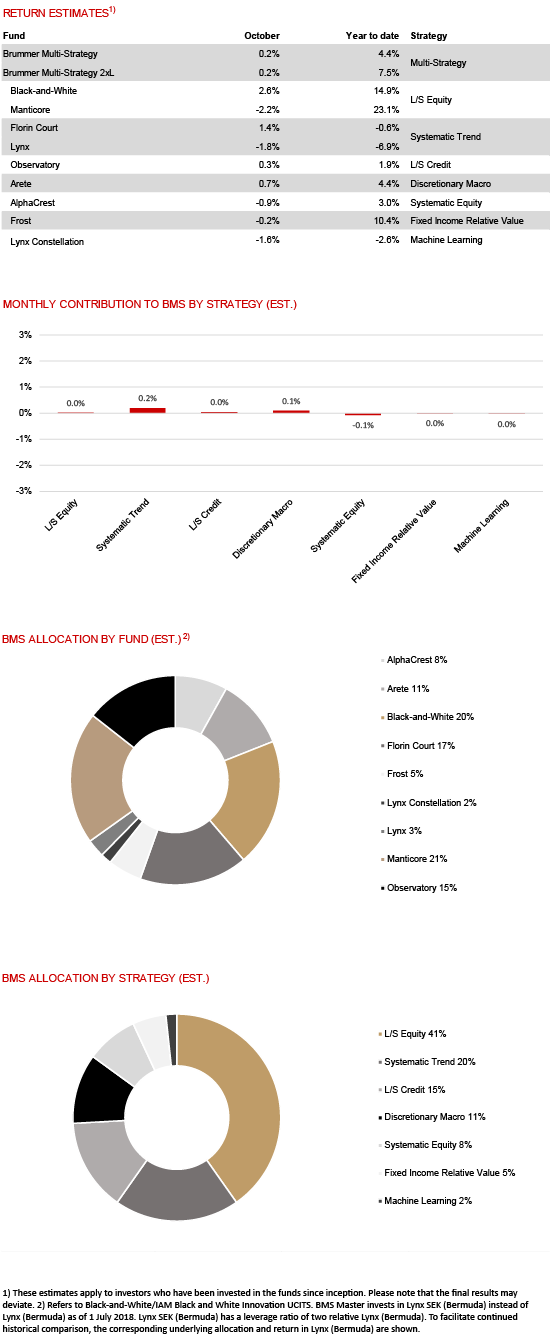

Brummer Multi-Strategy (BMS) SEK and Brummer Multi-Strategy 2xL (BMS 2xL) SEK posted estimated returns of 0.2 and 0.2 per cent respectively in October (0.1 and 0.2 per cent for the corresponding USD classes).

MARKETS

October started on a positive note, with equities buoyed by hopes of a last-minute deal to secure more US fiscal stimulus. However, an increase in Covid-19 infections and concerns about new restrictions sent most global stock markets lower for the month. In rates, the US yield curve steepened as markets priced in a Democratic election sweep leading to more aggressive fiscal policy. China’s economic recovery continues to gather pace driven by a strong industry and investment rebound while its currency has also continued to strengthen. In commodities, the price of oil fell on the back of decreased demand forecasts as Covid lockdowns return.

STRATEGIES WITHIN BRUMMER MULTI-STRATEGY

The largest contributor for the month was long/short equity strategy Black-and-White with alpha driving performance. Systematic trend following strategy Florin Court was also up for the month with gains primarily in power markets, emerging market fixed income, commodity markets and short dollar positioning. Macro strategy Arete capitalised on equity positioning while long/short credit strategy Observatory made money on European relative value trading. The month’s main detractor was long/short equity strategy Manticore which struggled with alpha specific losses. Fixed income relative value strategy Frost, systematic equities strategy AlphaCrest, machine learning strategy Lynx Constellation and trend following strategy Lynx were all marginal detractors to the month’s performance.

As of November 1st, BMS’s portfolio managers marginally increased its allocation to Black-and-White.