Brummer Multi-Strategy monthly commentary July 2021

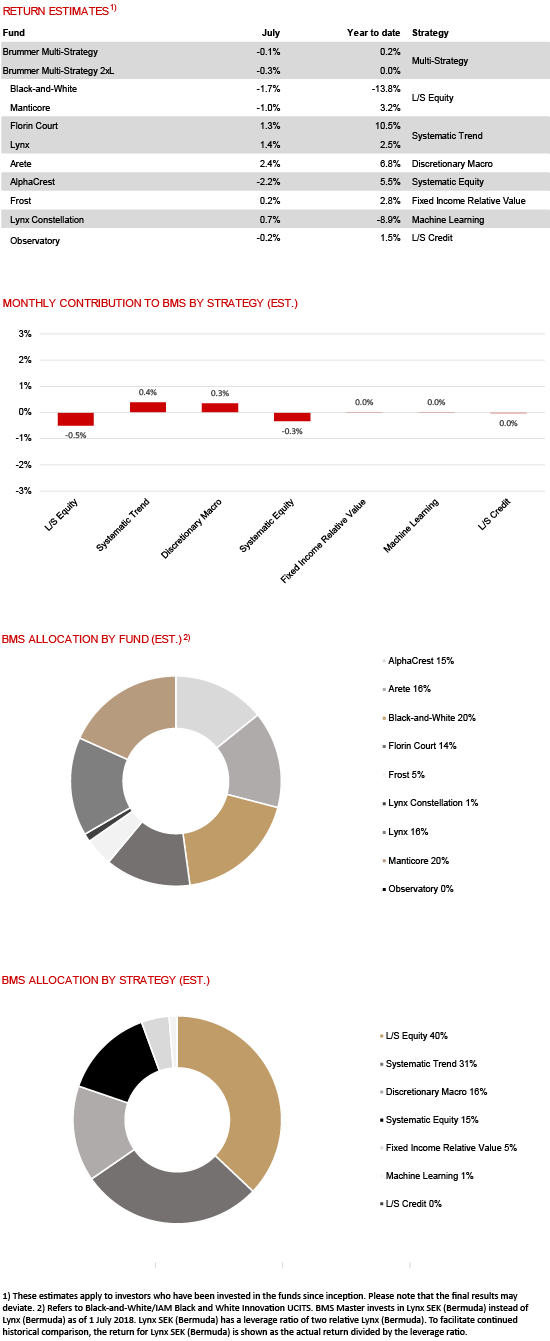

Brummer Multi-Strategy (BMS) SEK and Brummer Multi-Strategy 2xL (BMS 2xL) SEK posted an estimated return of -0.1 and -0.3 per cent respectively in July (-0.1 and -0.3 per cent for the corresponding USD classes).

MARKETS

US equity markets finished higher in July as caution over the spread of the Delta coronavirus variant eased while in China markets were weighed down by concerns over Beijing’s regulatory crackdown. Despite higher than expected US inflation numbers and hawkish indications from the federal reserve, bond yields moved lower during the month. In commodity markets it was a volatile month for the global oil benchmark Brent crude while in currency markets the dollar index finished lower.

STRATEGIES WITHIN BRUMMER MULTI-STRATEGY

Brummer Multi-Strategy ended July close to zero. Macro focused Arete navigated the month’s volatility well and made money on equity positioning. Trend following strategies Florin Court and Lynx contributed positively with gains from power and commodity positioning for the former and fixed income and equity positioning for the latter. Systematic equities strategy AlphaCrest as well as long/short equity strategies Black-and-White and Manticore were the month’s primary detractors mainly due to alpha specific losses. Fixed income relative value strategy Frost, machine-learning strategy Lynx Constellation and long/short credit strategy Observatory were all essentially flat for the month.

As of August 1st, BMS’s portfolio managers redeemed fully from Observatory, in line with the previously communicated redemption (for more detail click here).