Brummer Multi-Strategy monthly commentary June 2023

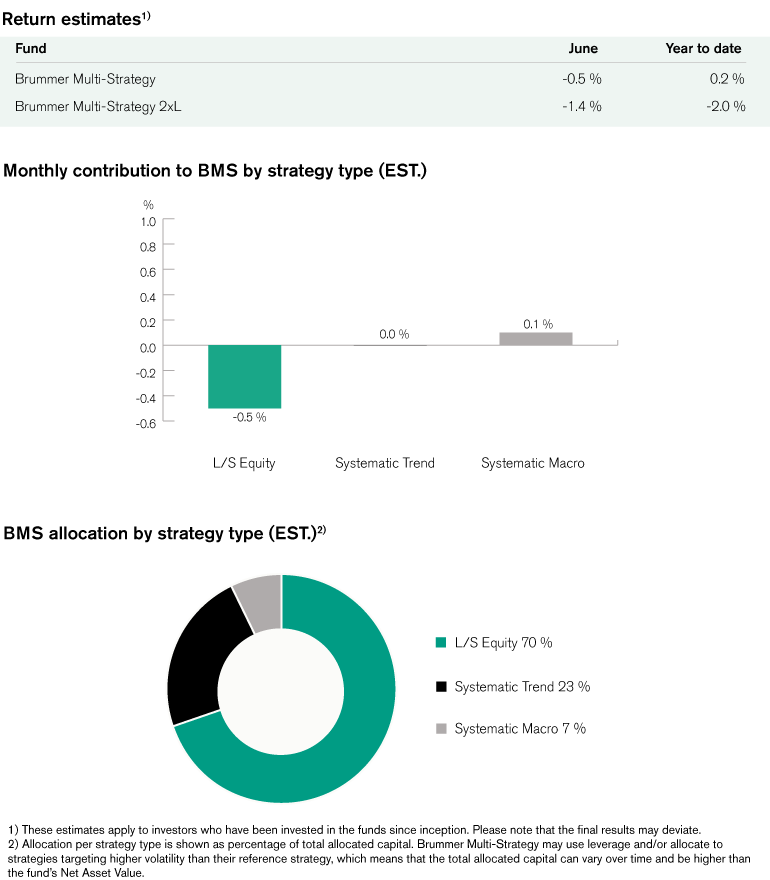

Brummer Multi-Strategy (BMS) SEK and Brummer Multi-Strategy 2xL (BMS 2xL) SEK posted an estimated return of -0.5 and -1.4 per cent respectively in June (-0.4 and -1.3 per cent for the corresponding USD classes).

MARKETS

US equities continued higher in June with the S&P 500 entering a new bull market after rising 20 per cent since its most recent low in October last year. The volatility index VIX fell to its lowest levels since the pandemic while equity markets in Europe and Asia were mixed. As widely anticipated, the Federal Reserve paused rate hikes for the first time since the start of its tightening cycle but at the same time gave a hawkish message that more rate hikes will come. The People's Bank of China cut its 1-year medium-term lending facility rate in response to slowing growth and to boost the economy. From other major central banks on both sides of the Atlantic, the market witnessed both expected and unexpected rate hikes this month. Short-term bond yields rose in the US and Europe as markets priced out rate cuts from the Federal Reserve later this year and the European Central Bank signalled further rate hikes. UK two-year gilt yields hit their highest level since 2008 on the back of persistent UK core inflation and expectations of Bank of England’s rate decision. In commodity markets, natural gas prices rose while oil prices fluctuated following OPEC+ production cuts and a potential weakening of demand on the back of interest rate decisions. The price of soybeans and wheat jumped mid-month before falling back, while gold and silver prices ended lower. In currency markets, the British pound strengthened against the US dollar while the Turkish lira recorded historical lows. The US dollar index weakened during the first half of the month and then strengthened somewhat following hawkish signals from the Fed Chairman Powell.

BRUMMER MULTI-STRATEGY

June was challenging for long/short equity which was the largest detracting strategy type for the month. Positioning within global industrials posted losses driven by poor long and short alpha, particularly in the capital goods sector. European financials and technology names in the Nordics and Europe were also a drag on performance. Companies within the banking, media and entertainment sectors detracted but gains were also realised from insurance and software services themes. On the positive side this month, positioning within the US TMT and global healthcare sectors held up well. In particular, US media and entertainment names contributed with solid long alpha while pharmaceuticals and biotechnology delivered strong long and short alpha.

Systematic trend-following finished flat for the month. Gains were spread across developed and alternative markets with positions in fixed income, currencies, equities, and credits most fruitful. Gains were however offset by losses from power and commodity markets.

Systematic macro contributed marginally. Rates accounted for significant gains with positions in both developed and emerging markets. Commodities and currencies were mixed while equities detracted.

As of July 1st, BMS portfolio managers increased the allocation to systematic trend-following and made some changes to the long/short equity composition.