Brummer Multi-Strategy UCITS monthly commentary February 2024

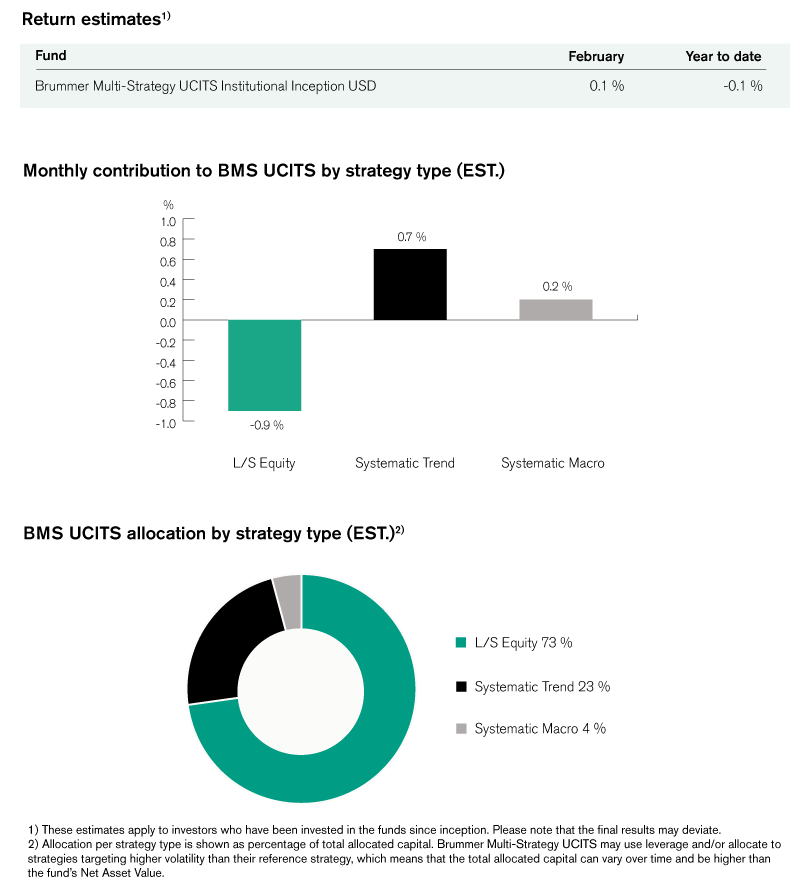

Brummer Multi-Strategy UCITS (Inst. Inception Class USD) posted an estimated return of 0.1 per cent in February.

Markets

This February saw equity markets rallying to new heights, mostly driven by strong Q4 earnings reports delivered by large and mega cap names. Bolstered by tech names continuing to beat earnings expectations, the S&P 500 entered new territory by crossing the 5000 mark and dragging western markets with it. Eastwards the Nikkei 225 index reached a new all time high, a first since the Japanese bubble economy of 1989, mainly driven by names in chipmaking rallying towards the end of the month. On the other end of the spectrum, February saw sovereign bonds falling following a hawkish Federal Open Market Committee as well as a strong US CPI print shifting sentiment towards a postponement of rate cuts. In spite of the hawkish sentiment in US markets, February saw the US dollar depreciating slightly against a basket of currencies, with the yen holding steady in particular. Oil prices were volatile this month, due to a combination of tensions in the middle east, mixed economic data and a higher than expected US inventory, ultimately ending higher for the month. Elsewhere, gold ended flat while most other metals faltered.

Brummer Multi-Strategy UCITS

Systematic trend following proved to be the most profitable strategy for the month of February. In developed markets, profits were made in every asset class save for fixed income which detracted slightly. Positioning in alternative markets proved somewhat less profitable where gains in power and credit were to some extent offset by fixed income and commodities.

Systematic macro also contributed positively this February, with relative value positioning in fixed income and foreign exchange contributing and equities detracting.

Long/short equity strategies were a drag on performance this month. Profits can mainly be attributed to positioning in the US TMT sector, where hardware, consumer discretionary and semiconductors proved most profitable. European financials detracted, wherein negative short and long alpha from the banking and diversified financials theme was slightly offset by gains in the insurance theme. Positions in the healthcare sector was a small detractor for the month, where negative short alpha from healthcare equipment was slightly offset by long alpha from pharmaceuticals. The industrial sector ended roughly flat for the month, with profits from the energy sector offset by short positions in automobiles and capital goods.

As of March 1st, BMS’ portfolio managers decreased the risk allocation to the industrial sector and systematic trend following on alternative markets somewhat, while increasing the risk allocation slightly to the remaining strategies.

This is marketing communication. Please refer to the prospectus and to the KIID/KID of the relevant fund before making any final investment decisions.