Brummer Multi-Strategy UCITS monthly commentary July 2024

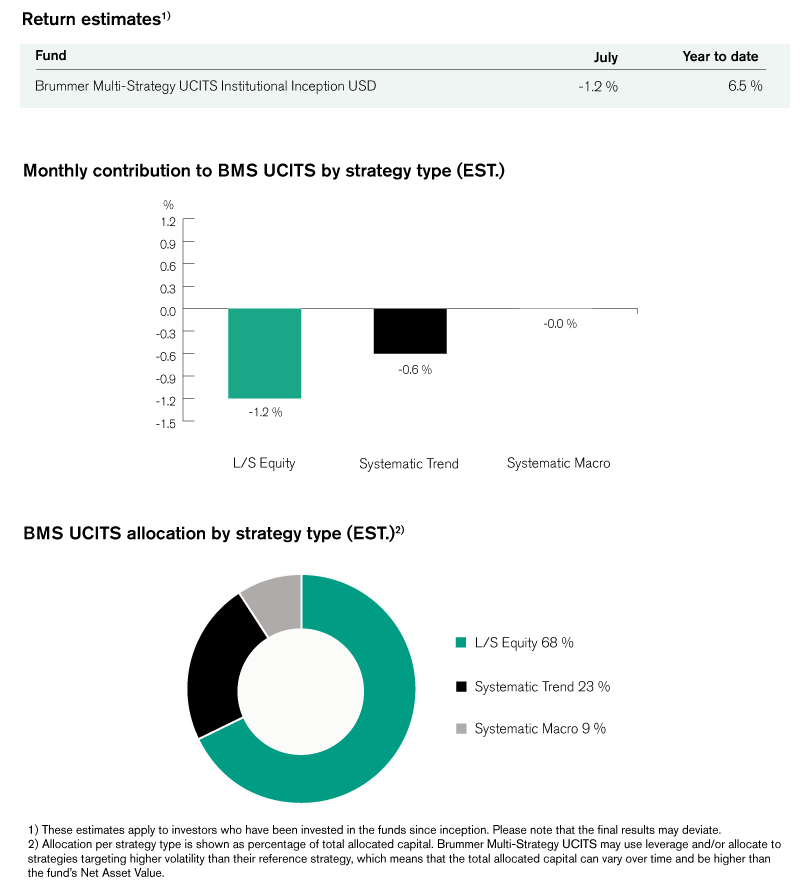

Brummer Multi-Strategy UCITS (Inst. Inception Class USD) posted an estimated return of -1.2 per cent in July bringing year to date performance to an estimated 6.5 per cent.

Markets

This July, politics took centre stage once more as election news, trade policy, new regimes and conflict all made their mark on asset classes. In the US, news of potential export restrictions on semi-conductors to China coupled with disappointing earnings reports from big tech names sent tech-heavy indices such as the Nasdaq 100 into a tumble, worsened by a global IT-outage that had near catastrophic effects on the US aviation industry. This, in tandem with investor hopes of rate cuts resulted in a sector rotation as investors increasingly flocked from AI-invested tech giants to more rate-sensitive small cap corporations. In the UK, a Labour landslide victory brought with it investor sentiment of economic stability and easing of monetary policy, causing the FTSE 100 to rally somewhat. In mainland Europe, markets ended roughly flat for the month as the positive reaction to the first-round results of the French elections were nullified by disappointing earnings reports. In the Far East, the Japanese Nikkei 225 fell following the BoJ’s decision to hike the interest rate by 15 basis points as an intervention for a record-weak Yen. Looking at bonds, yields moved lower for the month overall as disinflationary progress in the US drove down treasury yields, which rubbed off on other government bonds. The exception to this, of course, being Japanese government bonds whose shorter maturity bonds experienced higher yields due to the interest rate hike. Following the BoJ policy decision, the yen strengthened significantly throughout the month against the US dollar in particular, which in turn weakened against other major currencies. Following signs that Chinese industrials might slow down, oil prices took a tumble as investors expect the demand for fossil fuels to move lower. A slight increase towards the end of the month following further turmoil in the Middle East could not recoup what value was lost throughout July. Metals, both precious and base, moved lower during the month. The exception to this being gold, which moved higher.

Brummer Multi-Strategy UCITS

This July, trend followers detracted as equity and FX positioning proved costly. On developed markets, profitable positioning in fixed income were entirely offset by losses in equity positioning. On alternative markets meanwhile, the main detractors proved to be fixed income and FX which were partially offset by credits.

While several strategies within long/short equity proved quite profitable for BMS UCITS this month, their gains could not outweigh the losses accrued within the US TMT sector. Losses in that area can mainly be attributed to the software and semiconductor sectors. They were cushioned somewhat by profitable positioning in consumer and financial services. In European financials, profits were realised in the diversified financials and banking sectors, which were slightly offset by a few long positions within the insurance sector. Positioning in global healthcare sectors proved profitable this month, with the contributing sectors healthcare equipment and pharmaceuticals being slightly offset by life sciences.

BMS UCITS' systematic macro strategies diverged from one another this month, with the overall contribution being positive. The developed markets-focused strategy enjoyed profits from all subsectors, especially fixed income, save for FX which detracted some. Positioning in alternative markets was less profitable as gains in equity indices were offset by losses in fixed income and FX.

As of August 1st, BMS UCITS’ portfolio managers decided not to make any significant changes of the risk allocation in the portfolio.

This is marketing communication. Read the fund's information memorandum and key investor document (KID) before making any definitive investment decisions.