Brummer Multi-Strategy monthly commentary November 2024

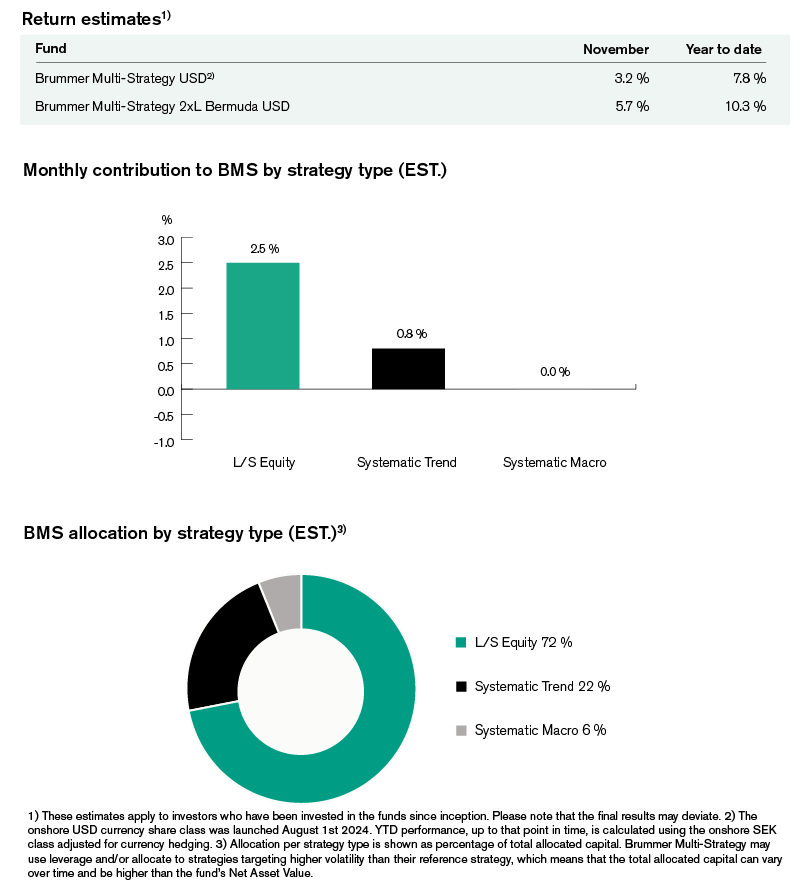

Brummer Multi-Strategy (BMS) USD and Brummer Multi-Strategy 2xL (Bermuda) USD posted an estimated return of 3.2 and 5.7 per cent respectively in November.

Markets

The world’s attention turned to the United States this month as the presidential election came to a close. The confirmation of Donald Trump’s return to the presidency triggered a sharp rally in U.S. equities, driven by promises of tax cuts and protectionist trade policies. However, the rally lost steam somewhat as rising US bond yields signalled potential inflationary pressures from the anticipated policy shifts.

In contrast, Trump’s win had a distinctly negative impact on European equity indices. The Italian FTSE MIB and French CAC 40 were particularly hard hit, ending the month with losses. Meanwhile, the German DAX and UK FTSE 100 managed a recovery by month’s end, bolstered by gains in a few select companies.

In Asia, Chinese markets bore the brunt of the global reaction to Trump’s victory. Concerns over potential tariffs dragged the Hong Kong-based Hang Seng Index down more than 400 basis points. Japanese equities initially surged on hopes of a Trump-led economic boost but reversed course as investors weighed the broader implications of protectionist policies. Disappointing corporate earnings and a sharp appreciation of the yen further dampened sentiment, culminating in a negative month for Japan’s markets.

In fixed income, U.S. bond yields initially spiked on expectations of growth-oriented policies under the new administration. However, they retreated somewhat after Scott Bessent’s nomination as Treasury Secretary and reassurances from the Federal Reserve that monetary policy would remain steady in the near term. In Europe, sovereign bond yields dropped sharply following the U.S. election. In currencies, the US dollar index reached two-year highs, also driven by expectations of tariffs and tax cuts potentially fuelling inflation and thus higher interest rates.

Commodities experienced mixed movements. Oil prices fluctuated throughout the month, ultimately declining after reports of a ceasefire between Israel and Lebanon. Precious metals like gold and silver also lost ground, finishing the month down.

Brummer Multi-Strategy

Alpha in the market neutral long/short equity bucket was the primary driver of returns in November. Positioning in the US TMT space was particularly profitable generating solid alpha both in the long and short book, performance was broad based with gains in Software, Internet, FinTech and Media/Telco names, particularly around earnings. Healthcare names were also very profitable in November with solid gains in pharmaceuticals, biotech and healthcare equipment. The remaining L/S equity sectors ended the month roughly flat.

Systematic trend following strategies were also profitable in November. In developed markets, long positioning in the US dollar and long positioning across European yield curves generated gains following the market moves post the Trump re-election. In alternative markets, profits were realized across sectors, except for power, with the greatest contribution coming from FX and equities.

The only marginal negative contribution to performance this month came from the systematic macro bucket where gains from FX and fixed income were entirely offset by equity positioning.

As of December 1st, Brummer Multi-Strategy has added two new market neutral long/short equity teams, one Nordics/Europe-focused short specialist and one specialising in listed real estate on the European and Canadian markets. The risk allocated to the new strategies was reallocated from the long/short equity and systematic macro buckets.

This is marketing communication. Read the fund's information memorandum and key investor document (KID) before making any definitive investment decisions.