Brummer Multi-Strategy monthly commentary November 2025

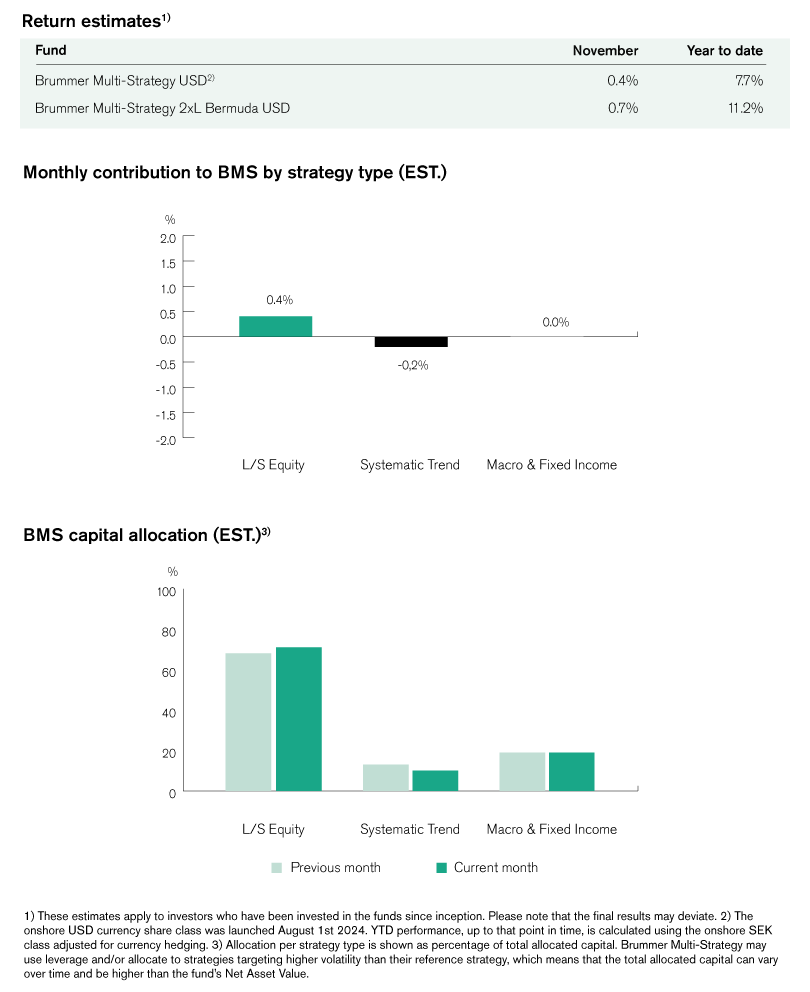

Brummer Multi-Strategy (BMS) USD and Brummer Multi-Strategy 2xL (Bermuda) USD posted estimated returns of 0.4 and 0.7 per cent respectively in November.

Markets

With the past six months being marked by significant rallies and optimism on several markets, November gave way to a more cautious tone. Market performance was generally muted as investors weighed the possibility of AI-related momentum slowing – or stalling altogether.

US equities entered the month with minor movements, as the government shutdown reached record lengths and investors nervously waited for Nvidia’s quarterly earnings report. Mid-month, concerns about a potential AI-driven market correction intensified, leading to a notable decline in technology sectors with Nvidia’s report doing little to quell negative sentiment. US equities did rebound somewhat however, as it seemed increasingly likely that the Fed might produce one more rate cut in December thus leading to the S&P 500 ending flat and the tech-heavy Nasdaq 100 ending down 1.6% for the month. European equity indices saw similar developments for the month, albeit in a more muted fashion, with major indices ending the month largely unchanged. Chinese equities saw limited activity, while Japanese and Korean equities declined sharply – likely a correction following last month’s exuberant rally driven by AI-related investments into local chipmakers.

Sovereign bond markets diverged in November. In the US, initial concerns over AI-related debt issuance created upwards pressure for Treasury bond yields causing them to rise initially. However, as the market priced in a higher likelihood of a December rate cut, yields ultimately moved lower for the month. In the Eurozone, German Bund yields moved slightly higher as the ECB gave no indication of further rate cuts. UK Gilt yields saw a rather dramatic rise ahead of the unveiling of the government’s budget only for it to drop as the budget detailed plans to finance additional government spending through higher taxes, rather than debt issuance. Following this, the US dollar weakened against most major currencies save for the Japanese yen. In commodity markets, WTI and crude oil moved lower as OPEC+ revised their Q3 outlook to indicate that there is a global surplus of oil rather than a deficit. Meanwhile, gold and other precious metals moved significantly higher for the month, further indicating the demand for a safe haven amid fears of an AI bubble.

Brummer Multi-Strategy

The L/S equity bucket was the biggest contributor to performance for the month, as the few detractors were more than offset by solid alpha gains. In US TMT, performance struggled somewhat, with losses in Semiconductors, Tech Hardware and Materials among others, partly offset by gains in Software and Capital Goods.

In global healthcare sectors, solid alpha was generated on both the short and long side with major gains in Pharmaceuticals & Biotech as well as Healthcare Equipment. These were lightly offset by positioning in Consumer Wares which did little to diminish a month of great performance in the space. As for listed real estate, gains were realised across markets with Eurocentric positioning proving the most profitable. Similarly, global financials saw positive performance contribution across the book, with positioning in Financial Services and Banks being standout alpha-generators, particularly in North America.

Discretionary fixed income & macro provided positive results for the month, thanks to profitable trades in Relative Macro, Risk Premia and Relative Value positioning. These gains were lightly offset by less profitable Inflation, Macro and Curve Trades.

Systematic macro struggled somewhat in November, as gains in Australian, Swiss, and Japanese equity indices were offset by positioning in FX, commodities and fixed income.

Systematic trend following proved to be the largest detractor for BMS in November, with the two strategies in the bucket diverging in performance. In developed markets, gains in fixed income were entirely offset by costly positioning in equity indices in the US and Asia along with less profitable positions in FX and commodities. In contrast, alternative markets showed positive performance driven by gains in energy-related commodities as well as emerging market bonds, partially offset by less favourable equity positioning.

This is marketing communication. Read the fund's information memorandum and key investor document (KID) before making any definitive investment decisions.