Brummer Multi-Strategy UCITS monthly commentary April 2025

Brummer Multi-Strategy UCITS (Inst. Inception Class USD) posted a return of -0.8 per cent in April, bringing year to date performance to -1.6 per cent.

Markets

As March drew to a close, investor sentiment grew increasingly cautious ahead of the anticipated “Liberation day” on April 2nd, when the White House was set to announce a set of new tariffs targeting both major and minor trading partners of the US. While expectations were already pessimistic, markets were still caught off-guard by the sheer extent and scale of the newly announced tariffs, triggering a spike in volatility and causing global market turmoil as investors reassessed global growth prospects. In a matter of days, equity markets shed trillions of dollars in market value, with major stock indices suffering double-digit declines. Losses were further intensified by swift retaliatory tariffs from China, deepening concerns about an escalating trade war. Volatility eased after Trump unexpectedly announced a pause on the so-called “reciprocal” tariffs on all affected parties save for China, sparking a rally in equity markets. When the dust settled, US equities managed to claw back much of their losses through the month, though weaker than expected GDP growth data ultimately sent both the S&P 500 and the Dow Jones into negative territory for the month. European indices fared similarly, save for Germany which saw its domestic DAX end in the positive for the month. In Asia, the Japanese Nikkei 225 moved higher for the month on the back of a stronger Yen while Chinese stock indices moved significantly lower in April due to the massive tariffs levied on Chinese exports.

Bond markets also saw significant turbulence. US Treasury yields surged in the aftermath of April 2nd, as investors dumped bonds amid concerns over the US dollar’s status as a safe haven. This yield-spike partially retraced after the confirmed pause on the “reciprocal” tariffs. In Europe, yields saw mixed developments. UK Gilts saw a similar yield-spike and subsequent retreat while the German long-term Bunds saw their yields rapidly decline throughout the month, possibly due to investors flocking to the bond as a new safe haven while capitalizing on their elevated yields due to the previous month’s unveiling of new defence and infrastructure spending.

Currency markets reflected the broader shift in sentiment. The US dollar continued its decline as its safe haven status became increasingly threatened, reaching its lowest level in three years with all major currencies appreciating heavily against it.

In commodities, gold prices surged as investors flocked to the commodity, viewing it as a stable asset in these volatile times. In contrast, other metals such as silver and copper as well as oil prices declined sharply post April 2nd due to the threat posed by the tariffs to global industries and manufacturing sectors, reflecting growing fears of a slowdown in global economic growth.

Brummer Multi-Strategy UCITS

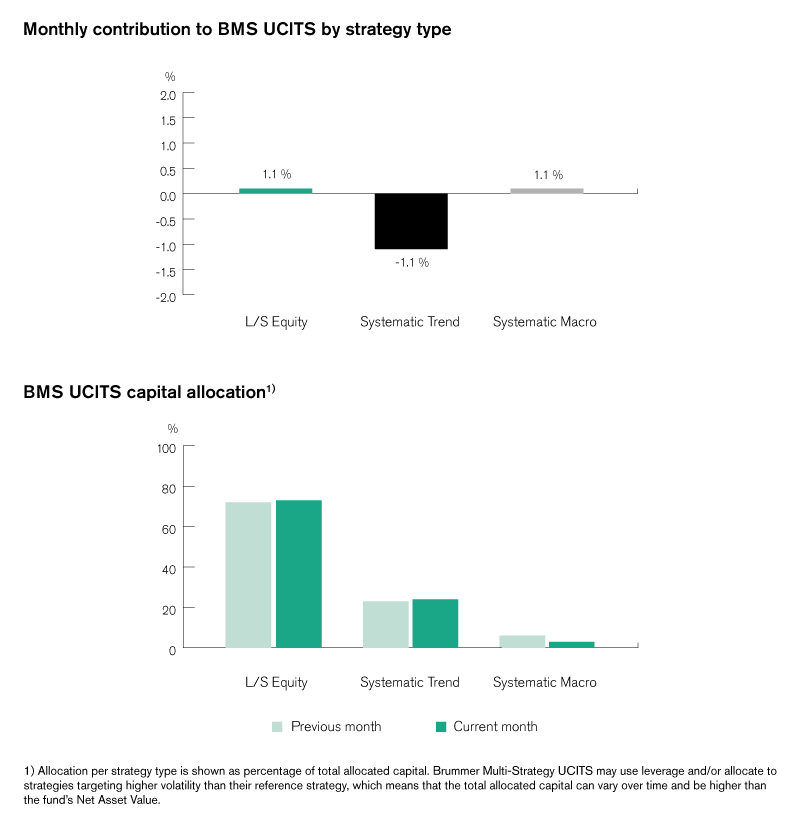

The contribution to performance from long/short equity was marginally positive as the strategy type proved quite resilient in April given the increased volatility and intra-stock correlations, delivering a modest 13bps for the month. The top contributing sector proved to be US TMT, where alpha was generated from positions in media & entertainment, telecommunications and e-commerce companies reporting earnings. Semiconductors and software & services detracted somewhat. The real estate sector also provided positive alpha in April, drawing positive performance from positions in European real estate management while real estate management in Canada detracted somewhat. The major detractor within long/short equity this April proved to be global healthcare sectors, where losses primarily stemmed from positions in healthcare equipment, a sector heavily affected by potential slowdowns in the global trade of manufacturing materials. The losses were somewhat offset by positions in pharmaceuticals, biotech and life sciences along with retail products.

Systematic macro managed to contribute marginally positively to BMS UCITS’s performance this month, in spite of the choppy market environment. There, gains were realised in fixed income and FX, offset somewhat by positions in equity indices.

The largest detractor to performance this month came from the systematic trend basket, where it proved nigh-impossible for trend models to pick up any strong trends given the erratic nature of April’s market developments and events. On developed markets, losses came primarily from equities, driven by long Europe and HK positions with some offsetting profits being short US equities, and FX, where short CHF and CAD lost money with the broad USD selloff. On alternative markets, losses in equity indices, credit and FX were offset by fixed income and commodities.

This is marketing communication. Read the fund's information memorandum and key investor document (KID) before making any definitive investment decisions.