Brummer Multi-Strategy UCITS monthly commentary February 2025

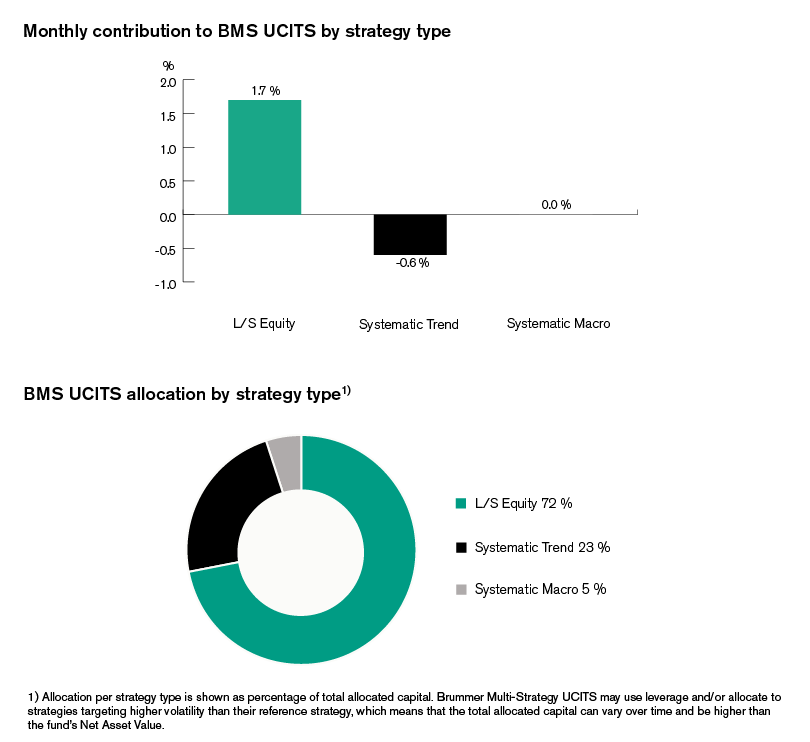

Brummer Multi-Strategy UCITS (Inst. Inception Class USD) posted a return of 0.9 per cent in February, bringing year to date performance to 1.6 per cent.

Markets

In February, markets gained initial momentum following the postponement of tariffs and Ukraine peace discussions, with US stock indices reaching all-time highs. Throughout the first half of the month, US equities were choppy but trended upwards as mixed earnings reports clashed with newly announced steel tariffs and inflationary pressure. Performance, however, took a sharp downturn towards the end of the month due to US Consumer sentiment reaching a 15-month low and an unexpected decline in Purchasing Managers’ Index (PMI). This rout was exacerbated by the assurance that the planned tariffs would be implemented according to plan. All in all, markets saw a wide rotation out of US equities as a whole.

Across the Atlantic, European equities continued to outperform, benefiting from a shift away from the US markets, a market-positive election outcome in Germany, and a strong rally in defence sector stocks. In Asia, Chinese equities rallied sharply throughout the month on the back of AI-optimism, earnings reports, as well as a more positive outlook on tech and the private sector from the Chinese Communist Party.

Sovereign bond yields moved lower overall for the month. US bond yields initially spiked due to inflation concerns but later retreated to their lowest levels since December 2024. European bond yields followed a similar, albeit more muted trajectory during the month.

As US bond yields fell more rapidly than those of other economies, the dollar depreciated against most currencies, particularly the yen which strengthened significantly this month. This can be attributed to possible future rate hikes from the Bank of Japan and Japan’s status as a safe haven amid tariff concerns and geopolitical instability. Meanwhile, gold prices enjoyed another month of steady performance while copper futures rallied.

Brummer Multi-Strategy UCITS

The market neutral long/short equity bucket was the primary driver of Brummer Multi-Strategy’s performance this month. Generating significant long and short alpha, the teams focused on US TMT sectors generated significant profits this earnings season with profitable positioning in software & services, media & entertainment, and commercial services. These gains were somewhat offset by losses in semiconductor and consumer discretionary sectors. In global healthcare sectors, gains were realised in pharmaceuticals, biotech and healthcare equipment while consumer durables detracted slightly. Positioning in European financials proved especially profitable this month, as gains were realised across each area of focus: banking, insurance, and diversified financials. Listed real estate ended in the negative for the month, as losses in real estate management and Real Estate Investment Trusts (REITs) were slightly offset by profits from assisted living facilities.

Systematic macro detracted for the month wherein gains stemming from long equity positioning were offset by losses in fixed income and commodities.

The main detracting strategy type for the month proved to be systematic trend. In developed markets, profitable positioning in equity indices and fixed income were entirely offset by losses in FX (USD) and various commodities. In alternative markets, power was the main detracting sector as energy prices diverged heavily in an erratic environment.

As of March 1st, BMS UCITS ’s portfolio managers decided not to rebalance the portfolio in any significant way.

This is marketing communication. Read the fund's information memorandum and key investor document (KID) before making any definitive investment decisions.