Brummer Multi-Strategy UCITS monthly commentary October 2025

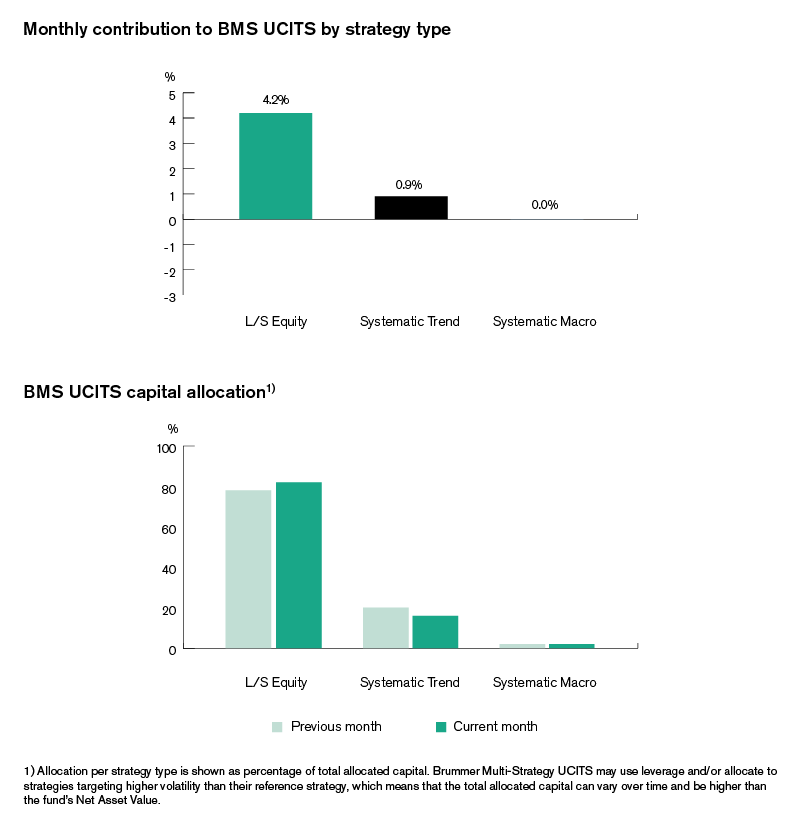

Brummer Multi-Strategy UCITS (Inst. Inception Class USD) posted a return of 4.1 per cent in October, bringing year to date performance to 10.7 per cent.

Markets

In October, market developments continued to be largely dictated by geopolitics and the AI theme. US equities started out strong for the month, as tech-giants helped lift performance in spite of the government shutdown. However, sentiment soon soured as President Trump threatened new tariffs on China in response to their restrictions on rare earth exports, causing a sharp drop in US stock indices. The slump was subsequently reversed in the latter half of the month as strong earnings reports continued to roll in, supported by a rate cut from the Federal Reserve.

European equities saw strong performance in October, buoyed by the same AI-driven momentum as US equities, alongside disinflationary trends and a surge in energy stocks thanks to fresh US sanctions on Russian oil. Further east, Asian stock markets saw more mixed developments. Chinese equities were rocked by threats of tariffs and ended the month lower, while Japanese equities rallied strongly amid a weakened Yen, bolstering exports following the appointment of Sanae Takeichi as prime minister.

The big boost to the region however came as OpenAI announced its partnership with South Korean chipmakers SK Hynix and Samsung for its $500bn Stargate data centre project. This announcement sent the Korean KOSPI index up by more than 20 per cent in October, dragging Japanese equities further upwards.

Bond markets saw most sovereign bond yields move lower for the month as inflationary metrics worldwide came in below expectations. The exception was the US, where inflation remained sticky and thus held up bond yields for the month, even as the Fed lowered its rate. This in turn caused the US dollar to appreciate against all major currencies, in particular against the Japanese yen since Prime Minister Sanae Takeichi has indicated a preference for lower rates.

In commodity markets, gold continued its historic rally in the first half of the month with its price climbing to a record high of $4,381 per troy ounce before experiencing a steep drop, ending roughly flat for the month. Oil prices had a rocky development as the ceasefire between Israel and Hamas caused WTI and brent prices to drop only for them to bounce back up as sanctions hit Russian oil.

Brummer Multi-Strategy UCITS

October proved fruitful for BMS UCITS’s underlying strategies as contribution was broad-based across sectors and produced yet another strong month.

The market neutral long/short equity bucket continued to prove its position as BMS UCITS’s backbone, with positive contribution to performance across all sectors.

In US TMT, the AI theme was prevalent as the largest performance driver in the portfolio was semiconductors, aided by profitable positioning in commercial & professional services and telecommunication. This was lightly offset by positioning in software and media & entertainment. Global healthcare sectors contributed heavily to performance this month as major profits were realised in North American names in pharmaceuticals, biotech & life sciences, which were minorly offset by positions in healthcare equipment.

Winners in the listed real estate sector proved to be UK and North America based names while other European names proved less profitable. Among global financials, UK banks along with financial services names drove performance which was lightly offset by a few insurance names.

Systematic trend continued its positive contribution to the portfolio, with recent trends holding fast in October. On developed markets, equity indices provided the largest contribution to performance thanks to favourable positioning in tech-heavy Asian and US indices, aided by profits from gold. The detractor this month proved to be fixed income. On alternative markets, contribution was more broad-based as equities, credits and FX contributed positively while fixed income detracted.

Systematic macro detracted somewhat for the month, with losses in FX (driven by the rally in USD) and fixed income being somewhat offset by profits in equities.

This is marketing communication. Read the fund's information memorandum and key investor document (KID) before making any definitive investment decisions.