Brummer Multi-Strategy monthly commentary January 2026

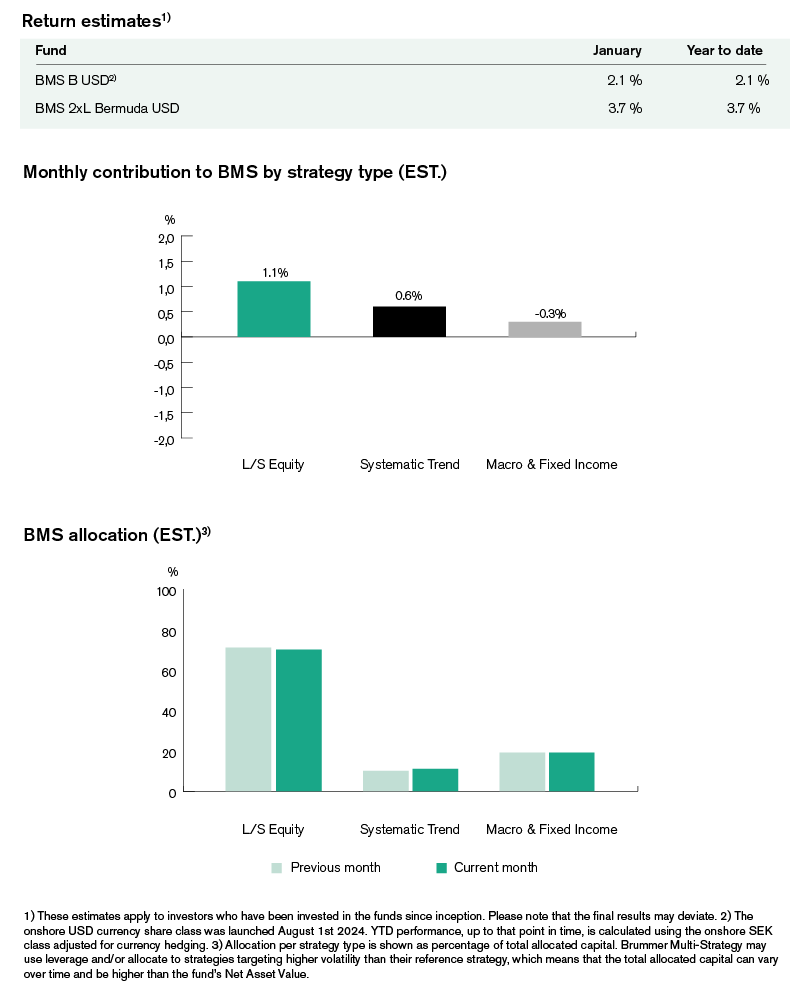

Brummer Multi-Strategy (BMS) USD and Brummer Multi-Strategy 2xL (Bermuda) USD posted estimated returns of 2.1 and 3.7 per cent respectively in January

Markets

Following an eventful 2025, the new year kicked off with full force as geopolitical instability rocked markets in January. As February gets underway, global attention remains firmly focused on the United States following a month marked by military actions, political brinkmanship and escalating rhetoric that might very well upend the current world order.

US equities started the year on strong footing, backed by broadly positive earnings reports and favourable macro prints. Sentiment deteriorated, however, following President Trump’s threat of tariffs in connection with statements regarding Greenland, causing a sharp sell-off in domestic indices such as the S&P 500 and Nasdaq 100. Markets subsequently rebounded as the president backed down on his threats, although volatility persisted. Several earnings releases disappointed, most notably Microsoft’s, where results fell short of expectations mostly driven by increased AI expenditure and slower growth in cloud services.

Despite the volatility, US equities ended the month in the positive, reflecting a potential rotation out of AI into other sectors in the region which saw gains. Across the Atlantic, European equities fared better with solid earnings reports and big names such as ASML driving performance alongside continued strength in the banking sector. Like the US, however, European markets initially sold off following the tariff threat before recouping losses and posting additional gains, supported by continued earnings resilience.

In Asia, Japanese equities saw heightened volatility as government bond yields rose and investors speculated about the possibility of a potential snap election. In China, markets advanced steadily as trade tensions eased somewhat and policy signals from the CCP pointed towards further measures aimed at stabilising the financial and real estate sector.

Looking at bond markets, US Treasury yields were also volatile amid a weakening dollar and growing tensions between a hawkish Federal Reserve and the current administration, raising concerns around central bank independence. Long-dated yields were particularly affected, with 5-, 7-, 10-, 20- and 30-year Treasury yields reaching their highest levels since September. On other markets, yield movements were more mixed, with European yields largely range-bound and Japanese yields continuing higher.

In the wake of January’s political uncertainty, trade tensions, and concerns over the Fed’s independence, the US dollar weakened significantly during the month, touching four-year lows. The currency rebounded somewhat upon the nomination of Kevin Warsh as Fed Chair, but the dollar was nonetheless weakened against most major currencies.

Commodity markets were among the most directly impacted by geopolitics this month as investors continued to flock to gold and silver as safe haven assets in the wake of recent developments, although both saw a sharp pullback late in the month following the Fed Chair nomination. Still, the price of the precious metals remained elevated at month-end. Oil prices were particularly volatile. Prices fell initially, following US actions in Venezuela and rhetoric around control of its oil reserves, before spiking later as tensions with Iran escalated in response to violent crackdowns on civilian protests. While tensions have eased somewhat, crude oil prices remain elevated. Elsewhere, natural gas prices surged as an unexpected winter storm swept over large parts of North America, impacting Mexico, the US and Canada.

Brummer Multi-Strategy

For the first month of the year, Brummer Multi-Strategy saw alpha generated from a wide spectrum of sources with most underlying PM teams contributing positively to performance.

Long/short equity was the largest contributing bucket this month, as performance was broad-based and spanned several sectors. Once again, the performance was mainly driven by the short book.

In US TMT, positioning in tech hardware, semiconductors, and commercial & professional services proved bountiful, slightly offset by minor losses in real estate, financials and healthcare services. Gains in global healthcare sectors could be attributed to profitable positions in healthcare equipment and consumer staples which were offset by positioning in pharmaceuticals, biotech & life sciences. In European financials, profits were realised across sectors with banking and insurance proving most profitable, exploiting dispersion in exceptionally strong sectors. Listed real estate also provided solid contribution for the month, with profitable positions in Europe and the Middle East outweighing less favourable ones in Canada.

Systematic trend-following gave solid performance contribution in January. In developed markets, the largest positive contribution came from equity indices and commodities, particularly from Asian equities, gold, silver and crude oil, while a few FX pairs and some commodities detracted. In alternative markets, gains were realised in commodities, in particular base metals, equities, and FX which were offset by fixed income positioning.

Systematic fixed income saw profits realised mainly thanks to positioning in US Treasury auctions, profiting off shorter duration bonds. Other gains were generated from Japanese bonds while UK Gilts detracted somewhat.

Discretionary fixed income RV & macro ended the month positive, thanks to profitable macro and medium term RV trades, which were mildly offset by less profitable curve trades.

Systematic Macro was flat for the month. Gains in commodities such as crude oil and natural gas as well as fixed income were offset by losses in FX and equity indices.

This is marketing communication. Read the fund's information memorandum and key investor document (KID) before making any definitive investment decisions.