Monthly commentary BMS February 2018

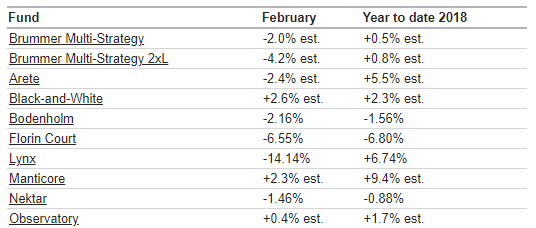

Brummer Multi-Strategy (BMS) posted a decline of 2.0 percent in February, but is up 0.5 percent in 2018. Hedge Fund Research’s HFRI Fund-of-Funds Composite Index decreased by 1.6 percent last month (USD based and should be compared with BMS USD which decreased 1.8 percent). Year-to-date HFRI has gained 0.7 percent (BMS USD is up 1.0 percent).

February was characterized by significant declines in equities and a dramatic surge in volatility. The frantic behavior seen in markets lately is primarily a result of increased investor nervousness with regards to higher inflation and interest rates. Positive US wage growth numbers last month, hence fueled fears of accelerated rate hikes by the Fed, causing markets to tumble. The US dollar strengthened against the remaining G5 currencies, with exception of the Japanese yen. In commodities, oil and natural gas prices posted declines, reversing the gains reported in January. Silver and aluminum also posted losses in the metals segment.

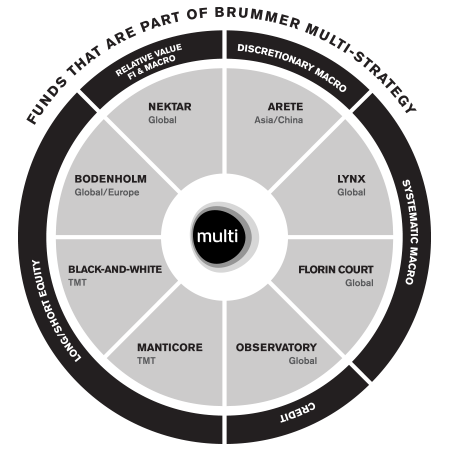

Several of the funds in which BMS invests struggled during February. The trend-following funds Lynx and Florin Court were the primary detractors, as rapid trend reversals in equities and commodities significantly hurt their performance. Macro fund Arete posted losses as a result of steep declines in Asian equity markets, while the relative value fund Nektar continued to post losses on its Swedish theme. On the positive side of the portfolio, the long/short equity funds Black-and-White and Manticore, both focusing on US tech, delivered strong alpha and were the two top contributors to BMS. The long/short credit fund Observatory also managed to post gains, despite a difficult market environment where high yield spreads widened.

Ahead of March, the overall allocation theme was a bit more defensive. BMS's portfolio managers decreased the allocation primarily to the systematic trend following strategies while increasing the allocation to more market neutral strategies.