Brummer Multi-Strategy monthly commentary August 2019

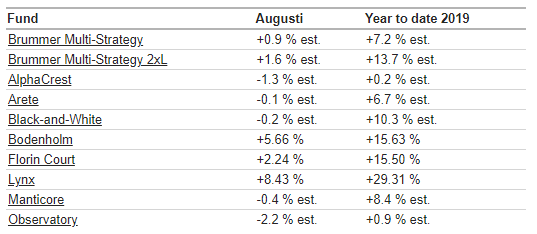

Brummer Multi-Strategy (BMS) SEK generated an estimated return of 0.9 per cent in August (1.0 per cent for the USD class).

Equities fell in August as markets reacted to increasing trade tensions, in the form of retaliatory tariffs from both the U.S. and China. Investors meanwhile sought safe havens in gold and bonds which both rallied during the month. The Federal Reserve hinted at another potential rate cut on the back of a weaker economic outlook. Unrest in Hong Kong escalated further, while Brexit uncertainty continued.

BMS fared well despite choppy equity markets. The long/short equity fund Bodenholm had its best month yet with significant alpha generated both from its long and short book. US based long/short equity funds Manticore and Black-and-White both ended the month marginally in the red. Systematic trend-following fund Lynx was the month’s best performer with fixed income positions driving significant gains, while systematic trend-following fund Florin Court capitalised on emerging market fixed income positions. Hong Kong based macro fund Arete closed the month roughly flat as equity positions were affected by tariff shocks. The primary detractors were long/short credit fund Observatory and systematic equities fund AlphaCrest.

As of 1 September, the portfolio managers made minor adjustments to the portfolio, increasing the allocation to Lynx somewhat.