Monthly commentary BMS May 2019

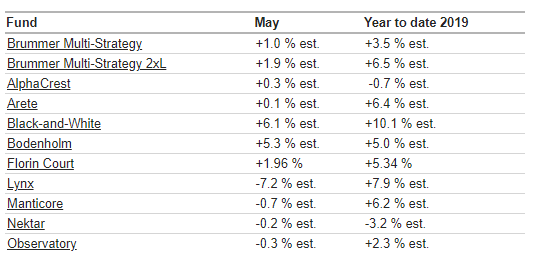

Brummer Multi-Strategy (BMS) SEK generated an estimated return of 1.0 per cent in May (1.2 per cent for the USD class).

Global equity markets sold-off in May following a breakdown in US-China trade and tariff negotiations. Investors meanwhile fled to safe haven government bonds which rallied markedly. In currencies the British pound fell on the back of continued Brexit uncertainty and Theresa May's resignation as Prime Minister. In commodities oil prices fell on concerns over global trade and increasing US production.

BMS’s performance in May was primarily attributable to positive contributions from the long/short equity strategies Black-and-White and Bodenholm. Both performed well despite sour equity markets, generating sizeable alpha on both long and short positions. After a strong start to the year the systematic trend-following fund Lynx was the month's largest detractor struggling with the sharp reversal in equities, while trend-follower Florin Court managed to capitalise on fixed income and credit positions ending the month positive. Long/short equity fund Manticore was slightly down while macro fund Arete, credit fund Observatory and systematic equities fund AlphaCrest were all essentially flat for the month.

As of June 1st, following from the redemption from the Nektar fund, the portfolio managers increased allocations to the remaining underlying managers with Black-and-White and Arete receiving a somewhat larger share.