Brummer Multi-Strategy monthly commentary August 2020

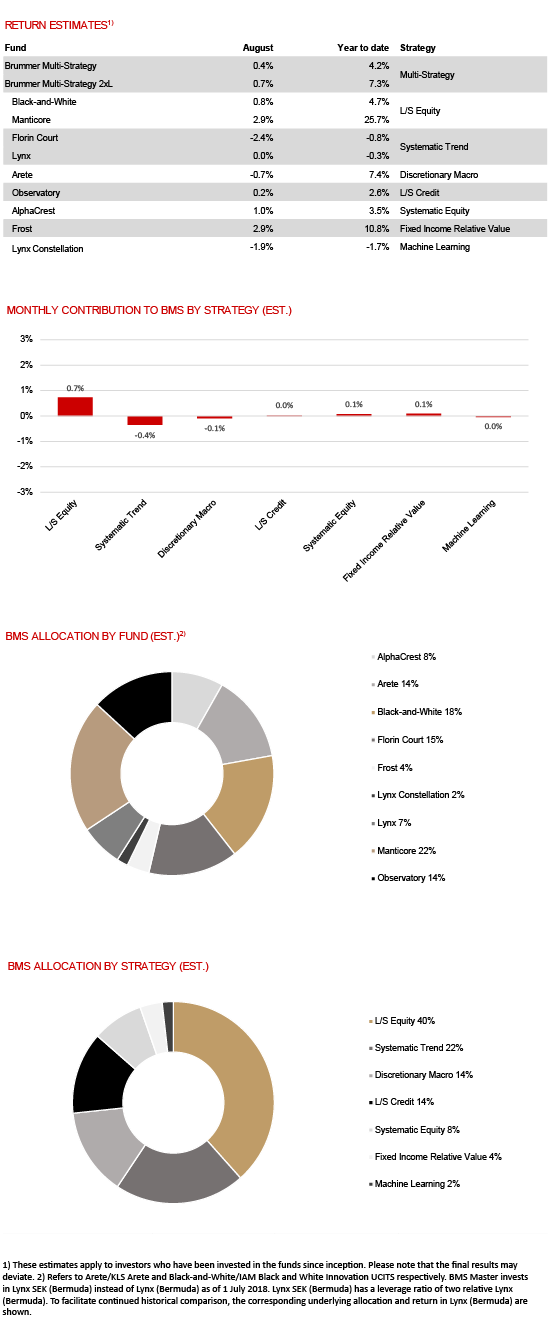

Brummer Multi-Strategy (BMS) SEK and Brummer Multi-Strategy 2xL (BMS 2xL) SEK posted estimated returns of 0.4 and 0.7 per cent respectively in August (0.4 and 0.8 per cent for the corresponding USD classes).

MARKETS

August was yet another strong month for equity markets with the benchmark S&P 500 index reaching an all-time peak, wiping out its pandemic losses. Dovish signals from the Federal Reserve, indicating rates will remain at record lows for a long time, led to a steepening of the US yield curve. In commodities, natural gas prices rallied as Hurricane Laura hit the Gulf of Mexico and, in precious metals, the price of gold fluctuated. The US dollar continued its downward slide against most major currencies while both the euro and sterling strengthened.

STRATEGIES WITHIN BRUMMER MULTI-STRATEGY

August was a good month for long/short equity strategies Manticore and Black-and-White, both generating solid alpha particularly from their long books. Fixed income relative value strategy Frost had another strong month, capitalising on the Swedish central bank’s continued balance sheet expansion. Systematic equities strategy AlphaCrest also performed well while long/short credit strategy Observatory and trend following strategy Lynx both finished the month marginally positive. The month’s largest detractor was the trend following strategy Florin Court, with August’s reversal in fixed income markets proving particularly difficult. Machine learning strategy Lynx Constellation also struggled in August, with the strong rally in natural gas prices as the primary detractor. Macro strategy Arete finished the month in negative territory as Hong Kong equity markets whipsawed.

As of September 1st, BMS’s portfolio managers marginally increased its allocation to Observatory and AlphaCrest.