Brummer Multi-Strategy monthly commentary May 2020

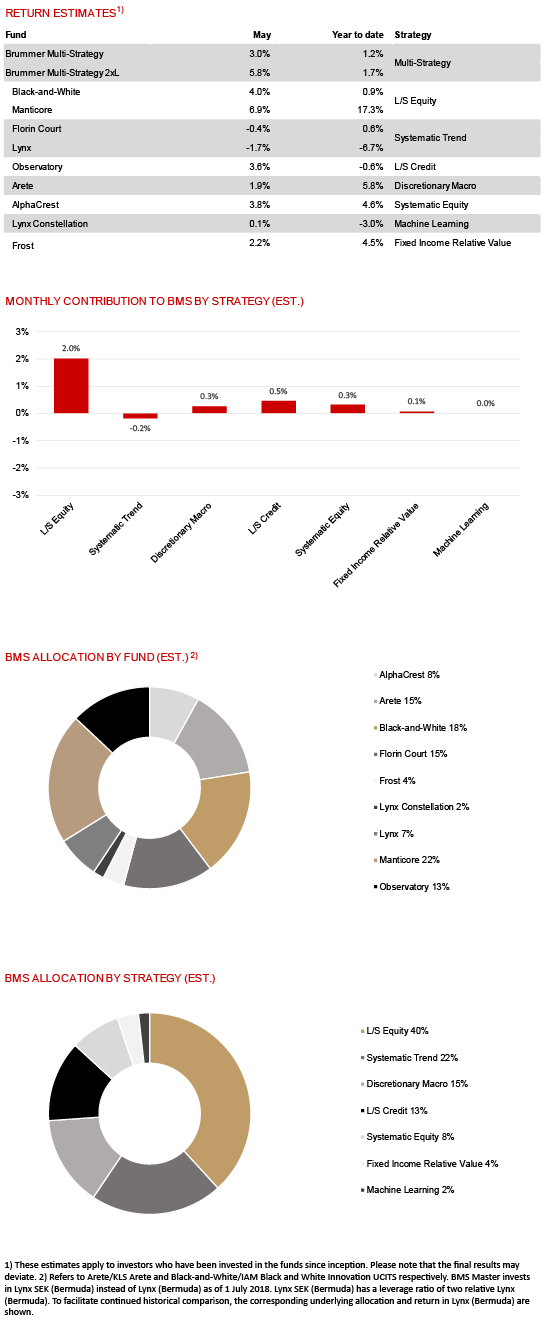

Brummer Multi-Strategy (BMS) SEK and Brummer Multi-Strategy 2xL (BMS 2xL) SEK posted estimated returns of 3.0 and 5.8 per cent respectively in May (3.0 and 5.9 per cent for the corresponding USD classes).

MARKETS

Equities continued higher in May with risk appetite fueled by hope of progress in finding a vaccine, the reopening of economies and expectations of further stimulus. Escalating US-China tensions, however, weighed on sentiment and added to recovery uncertainty. Oil prices increased as output fell and concerns over storage capacity subsided. In currencies both the US dollar and the British pound weakened while in fixed income markets bond yields moved somewhat higher during the month.

STRATEGIES WITHIN BRUMMER MULTI-STRATEGY

Seven out of nine investment strategies contributed positively to BMS’s performance in May. US based long/short equity funds Manticore and Black-and-White performed well, with the former in particular generating significant market neutral alpha. Long/short credit strategy Observatory made money on idiosyncratic fundamental relative value positions and systematic equities strategy AlphaCrest generated solid alpha. Hong Kong based macro strategy Arete had another good month with equity positions being the main driver, but also currencies, rates and commodities contributed. Fixed income relative value strategy Frost generated gains across most of its thematic exposures. Exotic trend following strategy Florin Court and machine learning strategy Lynx Constellation both finished the month essentially flat. Trend following strategy Lynx contributed negatively, with gains in long fixed income positions offset by trend reversals in energy prices and the US dollar.

As of June 1st, BMS’s portfolio managers only made some minor adjustments to the portfolio.