Brummer Multi-Strategy monthly commentary January 2021

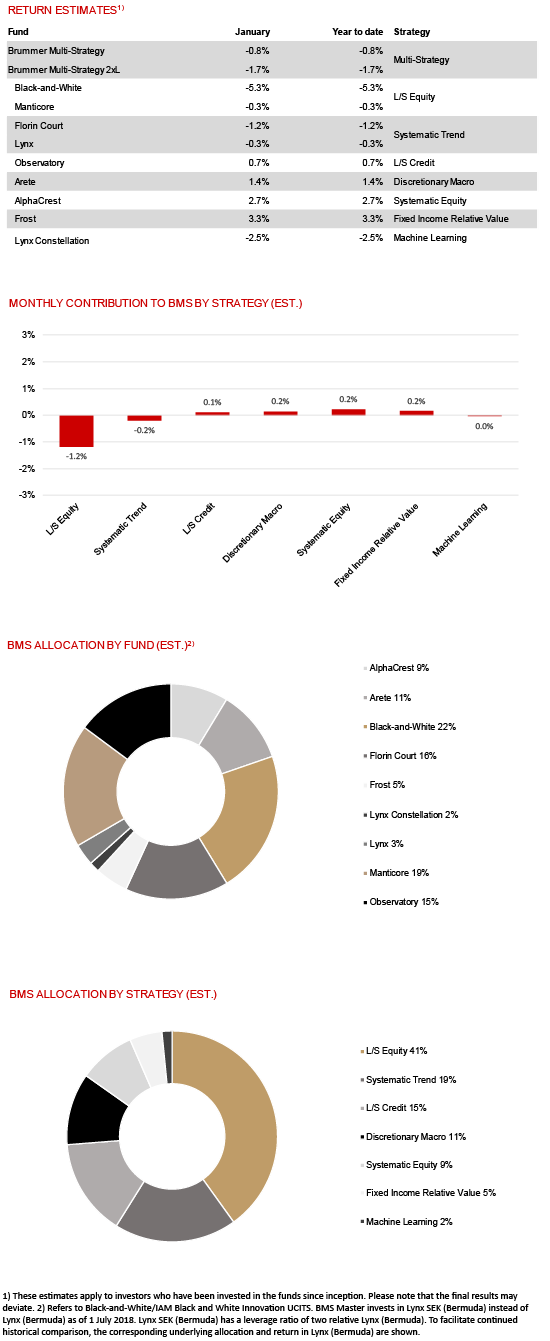

Brummer Multi-Strategy (BMS) SEK and Brummer Multi-Strategy 2xL (BMS 2xL) SEK posted an estimated decline of -0.8 and -1.7 per cent respectively in January (-0.9 and -1.7 per cent for the corresponding USD classes).

MARKETS

Equities and bond yields moved higher in early January as markets priced in further stimulus from the new Biden administration after the Democrats took control of both the House and the Senate in the US. With an increase in growth and inflation expectations, the US 10y treasury yield rose to its highest level since March 2020 as the Federal Reserve tried to reassure investors that it is far from ending its ultra-loose monetary policy. Risk appetite soured in the second half of the month as stimulus hopes faded and governments struggled to resolve vaccine supply issues while facing extended Covid restrictions. In spite of this, heavily shorted stocks rallied at month end, hyped on the online forum Reddit. In commodity markets crude oil prices continued higher, in currencies the British pound appreciated against the euro.

STRATEGIES WITHIN BRUMMER MULTI-STRATEGY

Brummer Multi-Strategy ended the month in negative territory. The month’s largest negative contribution came from the long/short equity strategy Black-and-White which struggled with poor short alpha. Systematic trend following strategy Florin Court was also down for the month with positioning in fixed income, credit, and currencies accounting for the majority of losses. Machine learning strategy Lynx Constellation, systematic trend following strategies Lynx and long/short equity strategy Manticore all detracted marginally. Systematic equity strategy AlphaCrest was the month’s strongest contributor and navigated the month’s volatility well, generating solid market neutral alpha. Macro focused Arete had another good month with equity trading being the main driver. Fixed income relative value strategy Frost generated strong gains across most of its thematic exposures, with fixed income curve positioning and FX positioning the biggest winners. Long/short credit strategy Observatory generated profits mainly from relative value trading.

As of February 1st, BMS’s portfolio managers made only minor adjustments to the portfolio.