Brummer Multi-Strategy monthly commentary November 2021

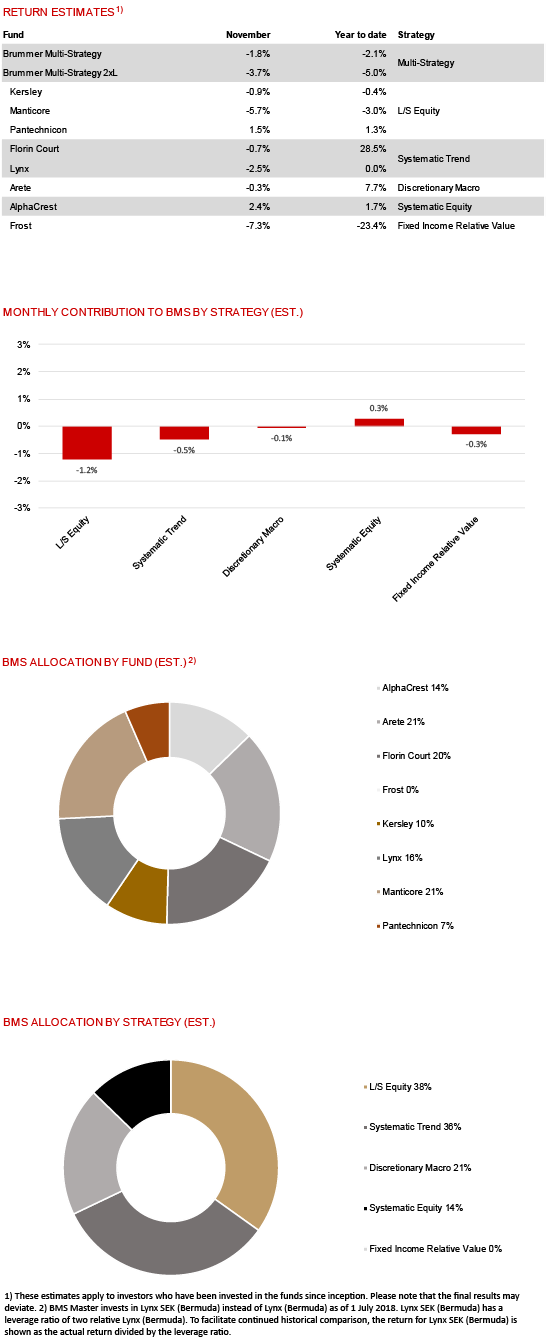

Brummer Multi-Strategy (BMS) SEK and Brummer Multi-Strategy 2xL (BMS 2xL) SEK posted an estimated return of -1.8 and -3.7 per cent respectively in November (-1.8 and -3.7 per cent for the corresponding USD classes).

MARKETS

Several events contributed to an increase in market volatility during November. In line with expectations, the US Federal Reserve announced a tapering of its bond purchases while the Bank of England surprised markets by deciding not to raise base rates despite previously hawkish comments. In the US, unemployment numbers continued their downward trajectory and the October inflation print exceeded estimates coming in at its highest level in three decades. Risk appetite soured towards end of the month triggered by renewed concern over a new coronavirus variant. Global equities, oil prices, the US dollar and bond yields all fell sharply as markets digested the economic consequences posed by the new variant.

STRATEGIES WITHIN BRUMMER MULTI-STRATEGY

In November, the systematic equities strategy AlphaCrest navigated the month’s volatility well with solid alpha across models. The long/short equity strategy Pantechnicon generated gains mainly from short positions and long alpha. Trend following strategy Florin Court and macro focused Arete were both essentially flat for the month. Gains for Florin Court in FX, power and equites were outweighed by losses in fixed income markets while Arete’s equity sector trading detracted marginally. The long/short equity strategy Kersley’s contribution was also slightly negative. The long/short equity strategy Manticore was the month’s biggest detractor with earnings related long alpha proving costly. Trend following strategy Lynx was unprofitable in November as losses in commodities, rates and equities outpaced gains in FX. Money markets continued to move against fixed income relative value strategy Frost during the beginning of November and the portfolio management team decided it best to wind down all positions and close the fund.

As of December 1st, BMS portfolio managers marginally increased the allocation to Florin Court, reduced Arete and Manticore’s allocation and redeemed fully from Frost’s 3.9 per cent allocation. Looking ahead, BMS will further add to the portfolio’s diversification through the addition of a new investment mandate. The new mandate is expected to launch during the spring of 2022 and will initially be exclusive to BMS investors.

For more information on Brummer Multi-Strategy's performance, please see the tables and graphs below.