Brummer Multi-Strategy monthly commentary February 2022

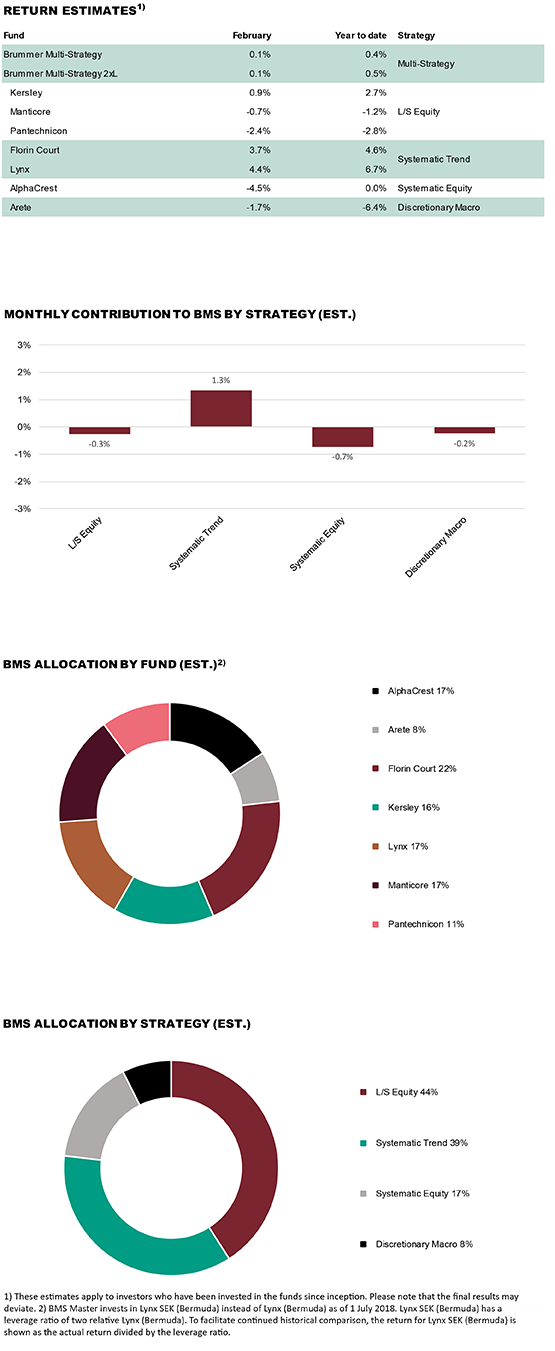

Brummer Multi-Strategy (BMS) SEK and Brummer Multi-Strategy 2xL (BMS 2xL) SEK posted an estimated return of 0.1 and 0.1 per cent respectively in February (0.1 and 0.1 per cent for the corresponding USD classes).

MARKETS

February began with above target inflation data in the Euro area, hawkish monetary announcements from the ECB and a rate hike from Bank of England. In the US, the rate of inflation rose to a 40-year high causing markets to price in an increasingly aggressive Federal Reserve response. Geopolitical concerns intensified gradually during the month and investor demand for safe haven assets increased. Toward month-end, tensions escalated as Russia began a full-scale invasion of Ukraine. Risk sentiment declined significantly in response to the war, causing global equity markets to fall while commodity prices surged. The price of metals and European natural gas soared while brent crude oil surpassed 100 dollars per barrel as sanctions against Russia fuelled concerns over supply disruptions. Fixed income markets were mixed during the month, whipsawed by rising inflation, monetary policy expectations and the conflict in eastern Europe.

STRATEGIES WITHIN BRUMMER MULTI-STRATEGY

Brummer Multi-Strategy finished the month in positive territory with trend following strategies performing particularly well. The majority of gains for both trend followers Lynx and Florin Court was in fixed income and commodity markets while currency positioning detracted from the former and cash equities from the latter. Financials-focused long/short equity strategy Kersley was also profitable in February with most investment themes generating gains. The month’s largest detractor was systematic equity strategy AlphaCrest which struggled to generate alpha during the month. Industrials-focused long/short equity strategy Pantechnicon was also a detractor with losses primarily in materials and capital goods sectors. Macro-focused Arete realised losses in developed market equity positioning while tech-focused long/short equity strategy Manticore finished marginally down.

As of March 1st, BMS’s portfolio managers decreased the allocation to Arete and increased the allocation to Kersley and Lynx.

For more information on Brummer Multi-Strategy's performance, please see the tables and graphs below.