Brummer Multi-Strategy monthly commentary March 2022

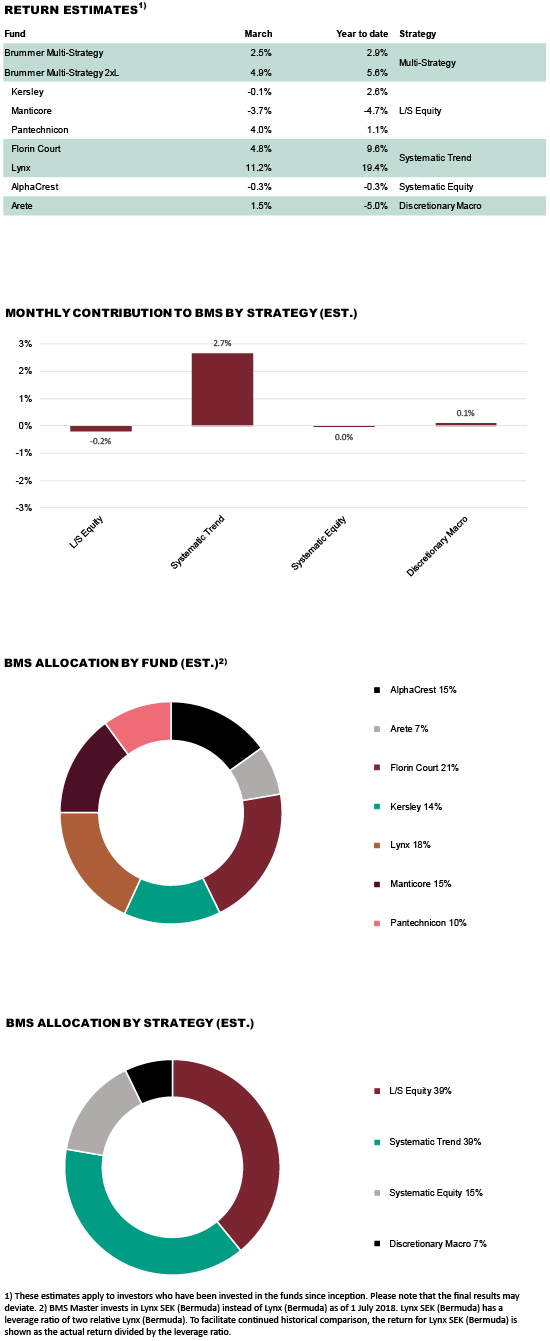

Brummer Multi-Strategy (BMS) SEK and Brummer Multi-Strategy 2xL (BMS 2xL) SEK posted an estimated return of 2.5 and 4.9 per cent respectively in March (2.5 and 5.0 per cent for the corresponding USD classes).

MARKETS

The Russia-Ukraine conflict and the resulting humanitarian crisis weighed on investors and markets in March, with many countries imposing sanctions on Russia. Amid geopolitical uncertainty, surging inflation and a tight labour market, the Federal Reserve hiked rates by 25 basis points, its first increase since 2018. The Bank of England also raised interest rates by a quarter of a percentage point, while the European Central Bank indicated a potential increase in interest rates as well as an end to its net bond purchase programme later this year. After an initial fall in global equity markets due to the war, several indices rose above pre-war levels. In commodity markets, oil was very volatile, affected by the Russia-Ukraine conflict, supply concerns and an increasing number of COVID cases in China. In fixed income markets, the US yield curve inverted at month-end, with the yield on the two-year Treasury note surpassing that of 10-year yields while the spread between 5- and 30-year yields fell below zero.

STRATEGIES WITHIN BRUMMER MULTI-STRATEGY

March was a strong month for BMS with most of the investment strategies contributing positively. The largest contributors were trend following strategies Lynx and Florin Court, both delivering solid gains in commodities and fixed income in particular. Industrials-focused long/short equity strategy Pantechnicon also contributed positively with strong alpha on both the long and short side. Macro-focused Arete made gains in US and Chinese equity markets. Tech-focused long/short equity strategy Manticore was the month’s main detractor, mainly due to alpha losses. Systematic equity strategy AlphaCrest detracted marginally and financials-focused long/short equity strategy Kersley was essentially flat for the month.

As of April 1st, BMS’s portfolio managers made minor adjustments to the portfolio, increasing allocation to Lynx and Florin Court.