Brummer Multi-Strategy monthly commentary February 2023

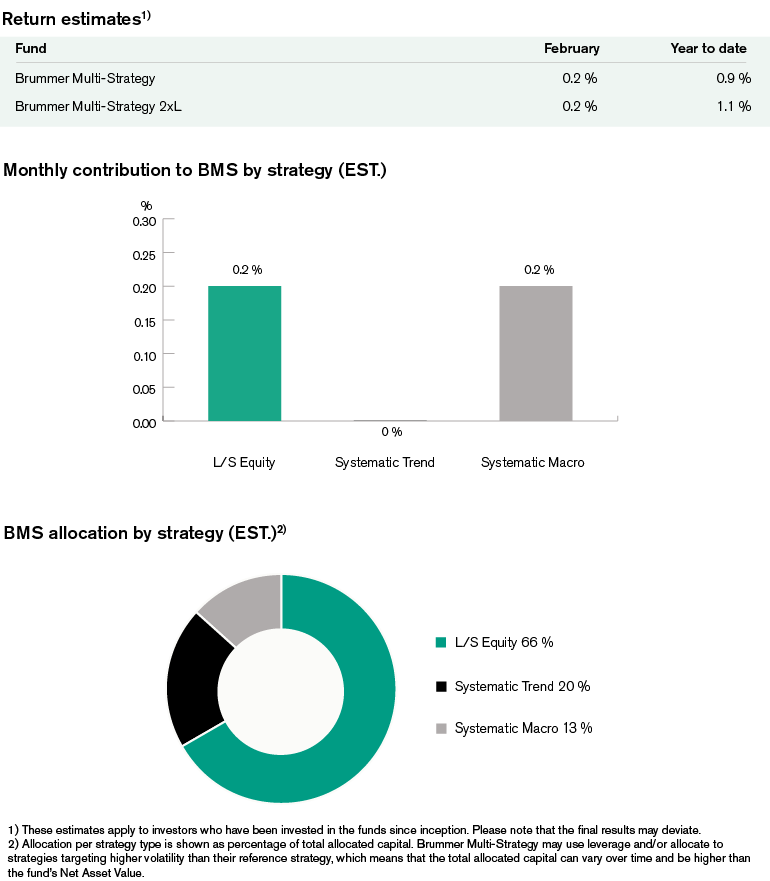

Brummer Multi-Strategy (BMS) SEK and Brummer Multi-Strategy 2xL (BMS 2xL) SEK posted an estimated return of 0.2 and 0.2 per cent respectively in February (0.4 and 0.3 per cent for the corresponding USD classes).

Markets

Higher than expected US January inflation numbers coupled with a slew of economic data pointing to signs of persistent inflation led investors to reprice interest rates remaining higher for longer. Equity markets were mixed in February, with the S&P 500 and Nasdaq indices ending lower. In Europe, positive earnings results helped to lift markets, Stoxx 600 ended higher and London’s FTSE 100 hit a new all-time high during the month. In fixed income, bond yields rose as markets priced in further rate hikes. In the US, the 2-year treasury yield rose to historically high levels relative to the 10-year treasury yield and the US dollar strengthened against a basket of currencies. In commodity markets, Brent and WTI prices seesawed during the month while gold and silver prices fell.

Strategies within Brummer Multi-Strategy

BMS generated positive returns in February with all strategy types contributing. Long/short equity was the largest contributor driven by positions in US TMT and the global industrials space. Gains came primarily from strong long and short alpha in the software sector as well as long alpha in the energy and material sectors. Marginal gains were also realised in the US and European health care sectors while positions in Nordic/European technology sectors and European financials weighed on performance. Systematic macro profited from most asset classes, especially relative value positioning in fixed income markets and equities. Systematic trend-following also generated gains in fixed income markets with short positions in European bonds particularly profitable. Foreign exchange was also additive as well as short positions in power markets. Losses came primarily from some positions in base and precious metals as well as grains.

As of March 1st, BMS’s portfolio managers increased the allocation to systematic macro and long/short equity and decreased the allocation to systematic trend.