Brummer Multi-Strategy monthly commentary November 2023

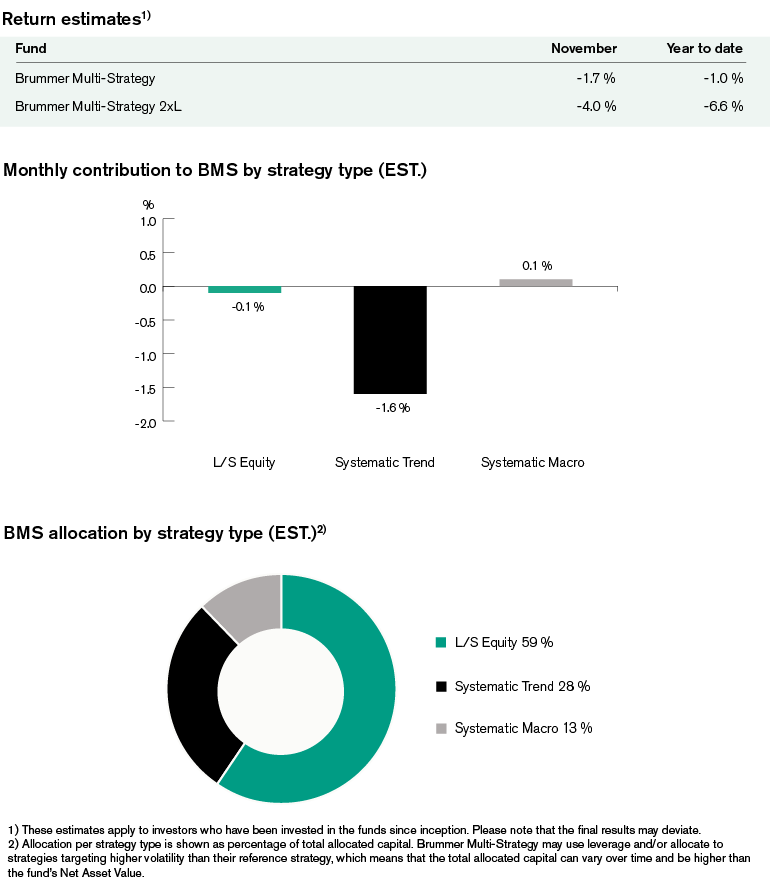

Brummer Multi-Strategy (BMS) SEK and Brummer Multi-Strategy 2xL (BMS 2xL) SEK posted an estimated return of -1.7 and -4.0 per cent respectively in November (-1.6 and -3.8 per cent for the USD classes).

Markets

Both equities and bonds rallied sharply in November as markets began pricing rate cuts early 2024. Weaker payrolls data, weaker CPI prints and the US Treasury announcing a lower pace of issuance of longer-dated maturities fuelled sentiment that the Federal Reserve will soon begin lowering interest rates. The rally in bonds caused US 10-year Treasury yields to fall more than 60 basis points during the month. On the back of this, equity markets rallied significantly with the S&P 500 posting its best month since July 2022, up 8.9 per cent. In commodity markets oil prices continued lower driven by a surplus in US supply and broader economic growth concerns while gold prices have continued higher. In foreign exchange markets, the US dollar weakened as market expectations priced in potential rate cuts by the Fed.

Brummer Multi-Strategy

Systematic trend-following was the main detractor in November where most of the losses can be attributed to positions in foreign exchange, equities, and bonds. Going into November, the trend-following strategies had a risk-off tilt which, given the sharp trend reversals in equities, bonds and FX, proved costly. Gains in power and alternative credit markets were far from enough to compensate for said losses. Despite being a difficult month for trend-following strategies, it is important to call to mind the primary purpose and function that trend followers provide in a diversified portfolio – namely protection in times of market stress, as was the case in 2022. Sharp trend reversals, however, are often difficult to capitalise on.

Long/short equity ended flat in November. European financials contributed with positive alpha, with the insurance and banking sectors proving particularly profitable. US TMT contributed marginally, with gains in media & entertainment names partly offset by losses in service sectors. Positions in global industrials negatively impacted alpha, the main detractor being negative short alpha from the capital goods sector, while profits from technology hardware & equipment and energy compensated somewhat. Positioning in the healthcare sector had a difficult month with short positions in biotech names among others proving less than fruitful.

Systematic macro ended marginally up. Positions in foreign exchange detracted, more so in developed markets than in emerging markets. Commodities in emerging markets contributed with some alpha with gains from positions in base metals and power.

As of December 1st, BMS’s portfolio managers made minor changes to the overall allocation between the strategy types. Within the long/short equity strategy bucket, the Nordic TMT sector strategy will no longer be a strategy BMS allocates to while in Q1 2024 a global technology and consumer discretionary sector focused strategy will be added.