Brummer Multi-Strategy UCITS monthly commentary July 2023

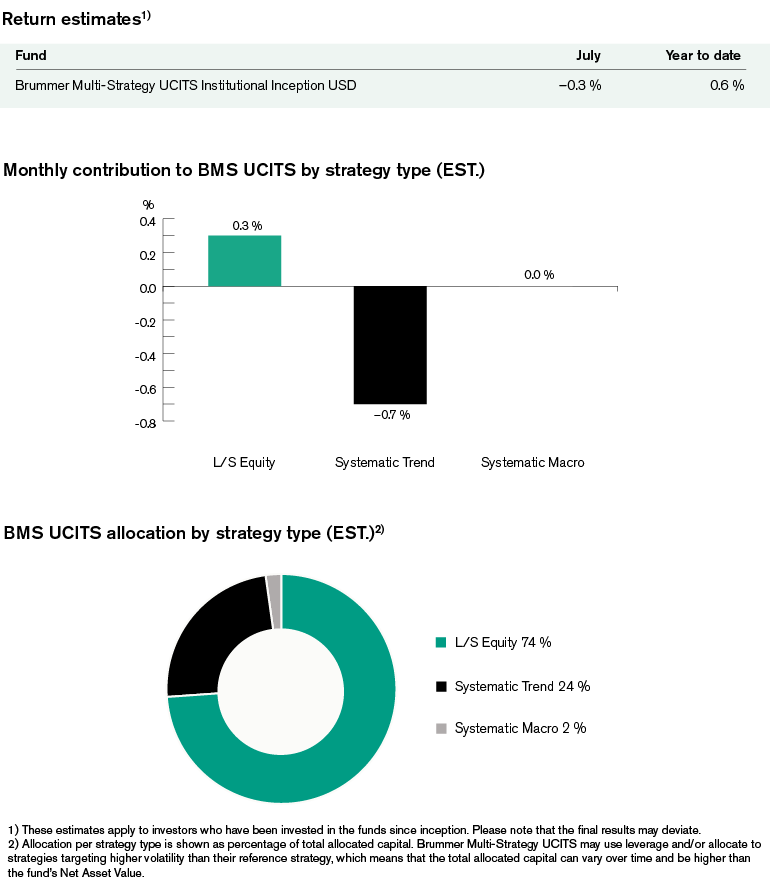

Brummer Multi-Strategy UCITS (Inst. Inception Class USD) posted an estimated return of -0.3 per cent in July.

Markets

US equity markets extended their streak of monthly gains in July as markets digested economic data and second quarter earnings coupled with shifting expectation of future rate hikes from central banks as well as the economic outlook. Increasing bets on further rate hikes initially contributed to rising yields and falling equities in the US and Europe. As the month proceeded, corporate earnings reports as well as economic data supporting hopes of less hawkish central banks in the foreseeable future helped boost equity markets. Asian markets were mixed with the economic activity in China indicating a slowdown. Yields on 10-year Japanese government bonds rose to its highest level since 2014 following Bank of Japan’s unexpected month-end policy change. In commodity markets, Brent and WTI oil climbed higher, as did the price of gold and silver. Wheat and corn prices seesawed, while sugar prices moved higher. In currency markets, the euro and British pound strengthened against the US dollar during the first part of the month before weakening.

Brummer Multi-Strategy UCITS

Long/short equity contributed with most strategies navigating the month well on the back of the earnings season. Long positions within media and entertainment, banks and insurance as well as pharmaceuticals and biotechnology were among the most profitable. Gains were also realised in the IT sector, stemming from good short alpha. Short positions in the global industrials sectors were costly however, weighing on the overall returns within long/short equity.

Systematic trend-following detracted on a strategy type level, but realised both gains and losses across asset classes and markets. Losses came mainly from currencies, interest rates and to a lesser degree from equities positioning, whilst solid gains were generated in credits. Contributions from commodities positioning were mixed with some gains in power and energies while positions in agricultural sectors detracted.

Systematic macro finished roughly flat for the month.

As of August 1st, BMS UCITS portfolio managers decreased the allocation to long/short equity.