Brummer Multi-Strategy monthly commentary April 2023

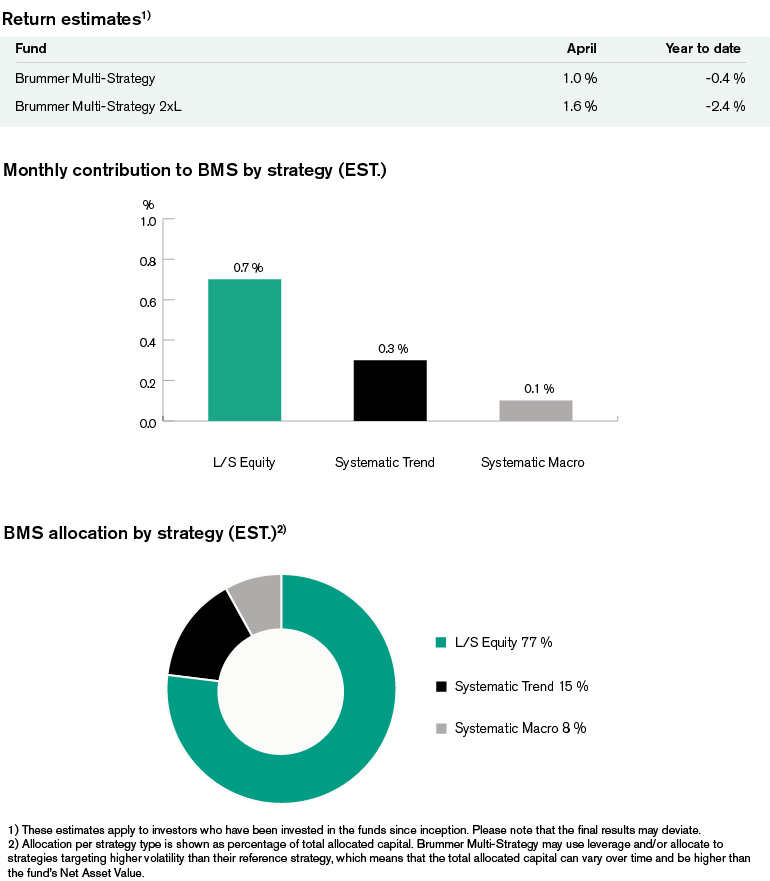

Brummer Multi-Strategy (BMS) SEK and Brummer Multi-Strategy 2xL (BMS 2xL) SEK posted an estimated return of 1.0 and 1.6 per cent respectively in April (1.1 and 1.7 per cent for the corresponding USD classes).

Markets

Equity markets were mixed in April, largely ending flat in the US and Europe. First quarter earnings releases were in focus with many larger banks primarily in the US showing sign of strength. US technology stocks rallied on the back of stronger than expected quarterly results. In fixed income markets, investors weighed the possibility that the Federal Reserve will pause interest rate hikes against continued tightening followed by interest rate cuts later this year. Persistent double-digit UK inflation fuelled expectations of more interest rate hikes from Bank of England, which contributed to rising bond yields. The euro and British pound strengthened against the US dollar in currency markets and the latter ended the month largely flat against a basket of currencies. Oil prices rose in commodity markets after Opec+ announced production cuts but fell thereafter on the back of demand concerns. The price of sugar increased while soybeans and wheat ended lower.

Strategies within Brummer Multi-Strategy

BMS generated positive returns in April with all strategy types contributing positively. Long/short equity teams generated alpha across most sectors. Most significant was long and short alpha realised in the US software sector as well as in global capital goods sectors. Positions in European software and financials sectors were also fruitful particularly long alpha. Positioning in the global health care sector detracted marginally. Systematic trend-following strategies were also profitable with gains primarily coming from power, equities and currencies outweighing losses from rates and commodities. Systematic macro generated gains from relative value positioning within equities in both developed and emerging markets. Commodities positioning on the other hand detracted marginally driven by positions in base metals while returns from currencies and fixed income were additive to BMS performance.

As of May 1st, BMS’s portfolio managers decreased the allocation to systematic trend-following.