Brummer Multi-Strategy UCITS monthly commentary April 2024

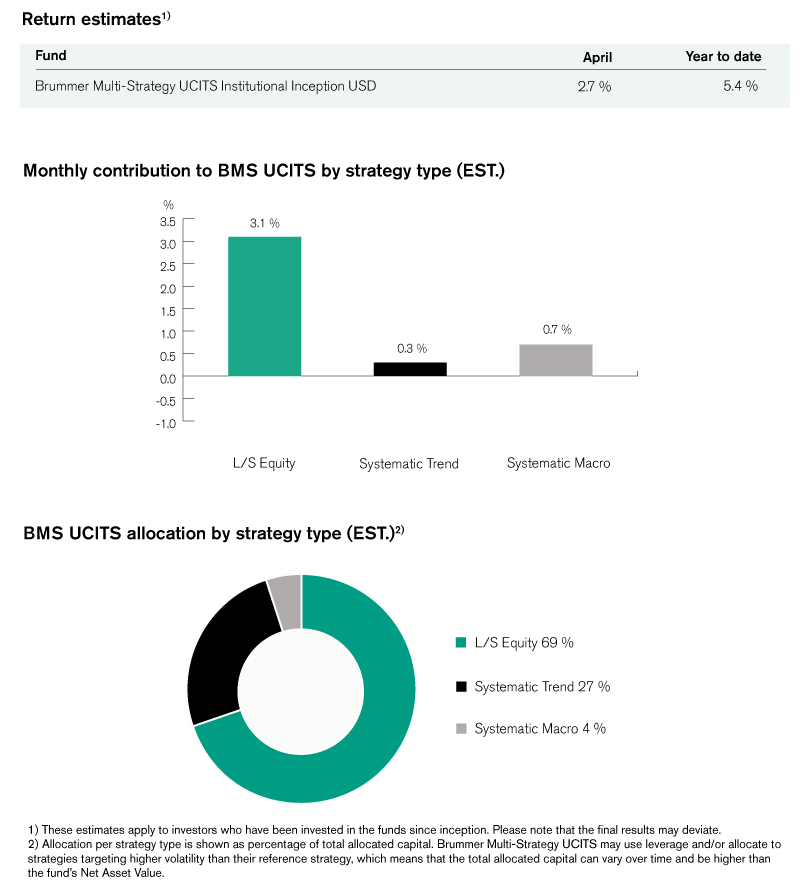

Brummer Multi-Strategy UCITS (Inst. Inception Class USD) posted an estimated return of 2.7 per cent in April.

Markets

April was a turbulent month for markets as fears of US stagflation and further geopolitical turmoil resonated across the globe. US equities saw a rather steady decline over the month on the back of inflation rising and Q1 growth stagnating, far above and slightly below expectations respectively. Some losses were recouped at the tail-end of the month as mega-cap names provided strong Q1 earnings reports. In Europe, equity performance was mixed as the Stoxx Europe 600 index moved lower in spite of dovish ECB comments while the FTSE 100 ended the month higher as domestic PMIs exceeded expectations. Following a record setting March, the Nikkei 225 took a tumble this month, in large part fueled by a weakened yen. US inflation figures solidified expectations of a delay in rate cuts leading US treasury yields sharply higher dragging German Bunds and UK Gilts up with them. The US dollar also strengthened during the month, as markets expect the Fed to lag behind other central banks when it comes to cutting rates. Events in the Middle East once again left a mark on commodity markets leading to a spike in oil prices although this was later tempered by increased US supply. The easing of tensions towards the end of the month made its mark on the price of gold, as its steep rally tapered off.

Brummer Multi-Strategy UCITS

Trend following strategies contributed marginally positive. In alternative markets, profitable positioning in fixed income was largely offset by losses stemming from credit and equity positions. FX and fixed income positioning proved to be the most profitable asset classes in developed markets but was partly offset by losses in equities and commodities.

Long/short equity delivered solid alpha contribution to BMS in April. The US TMT sector proved particularly profitable, with solid short alpha across sectors which was marginally offset by positioning in mega cap tech names as well as financial services and real estate. Across the Atlantic, European financials enjoyed another strong month attributable to the banking sector as well as some names in the diversified financials space. Positioning in the healthcare sector ended roughly flat for the month, as profitable shorts in pharmaceuticals were offset by detractors in healthcare equipment. In the global industrials sector, profits were primarily driven by names in the capital goods and materials sectors.

Systematic macro was solidly profitable for the month. With gains stemming primarily from fixed income and FX positioning on developed markets.

As of May 1st, only minor adjustments were made between the various strategy type buckets. Within the long/short equity bucket, the portfolio managers allocated to a new TMT and consumer discretionary strategy and decreased allocation to the other long/short equity strategies. Further, there will going forward be no risk allocation to the strategy focusing on the industrials sector.

This is marketing communication. Please refer to the prospectus and to the KIID/KID of the relevant fund before making any final investment decisions.